Should You Pick FedEx Stock At $250 Ahead of Q4 Results?

FedEx (NYSE: FDX) is scheduled to report its fiscal Q4 2024 results on Tuesday, June 25 (FedEx’s fiscal ends in May). We expect FDX stock to trade higher post the Q4 announcement, with its revenue and earnings expected to be above the street estimates. The company should continue to benefit from its cost reduction actions, while average daily volumes will likely stabilize. Not only do we think FedEx navigated well in Q4, we think its stock has ample room for growth from its current levels of around $250. Our interactive dashboard analysis of FedEx’s Earnings Preview has more details on how the company’s revenues and earnings will likely trend for the quarter. So, what are some trends likely to drive FedEx’s results, and how has the company’s stock performed?

Firstly, let us look at FedEx’s stock performance in recent years. It has seen little change, moving slightly from levels of $260 in early January 2021 to around $250 now. This compares with an increase of about 45% for the S&P 500 over this roughly three-year period. Overall, the performance of FDX stock with respect to the index has been lackluster. Returns for the stock were 0% in 2021, -33% in 2022, and 46% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 — indicating that FDX underperformed the S&P in 2021 and 2022.

In fact, consistently beating the S&P 500 — in good times and bad — has been difficult over recent years for individual stocks; for heavyweights in the Industrials sector, including CAT and UNP, and even for the megacap stars GOOG, TSLA, and MSFT. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride, as evident in HQ Portfolio performance metrics.

- What’s Next For FedEx Stock After A Dismal Q1?

- What To Expect From FedEx’s Q1

- Should You Pick FedEx Stock At $300 After An Upbeat Q4?

- Should You Pick FedEx Stock At $300 After Q3 Earnings Beat?

- What To Expect From FedEx’s Q3 After 20% Gains In A Year?

- Up 30% In A Year Is FedEx Stock A Better Pick Over UPS?

Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could FDX face a similar situation as it did in 2021 and 2022 and underperform the S&P over the next 12 months — or will it see a strong jump? From a valuation perspective, FDX stock appears to have some room for growth. We estimate FedEx’s Valuation to be $294 per share, 18% above its current market price of $250. Our estimate is based on a 14x forward expected adjusted earnings of $21.47 in fiscal 2025. The 14x P/E multiple aligns with the stock’s average over the last five years.

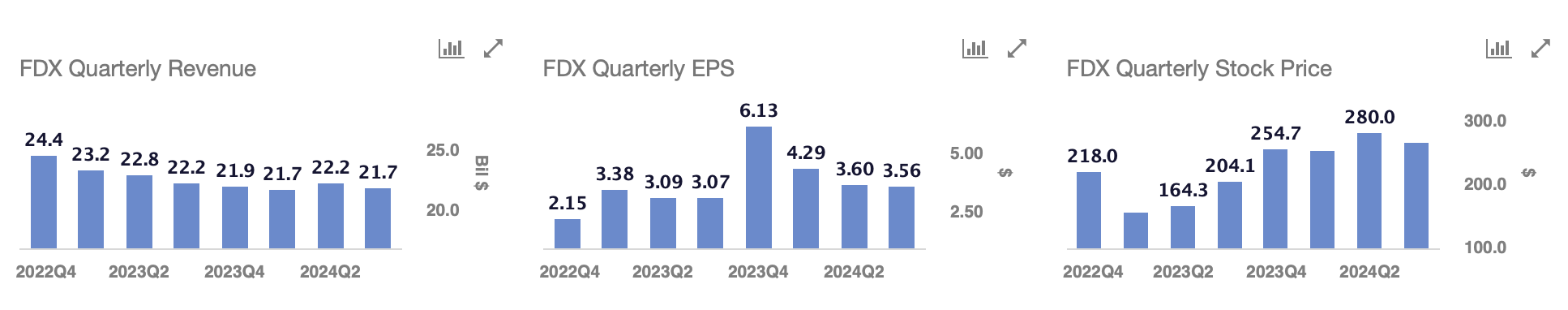

Looking at the previous quarter, FedEx’s Revenue fell 2% y-o-y to $21.7 billion, primarily due to lower average volumes. The overall top-line fell slightly short of our estimates. The Express and Ground average daily package volume declined 1.1% y-o-y. FedEx saw its adjusted operating margin expand by 90 bps to 6.2% in Q3’24. This clubbed with a 1% decline in average shares outstanding, amid share repurchases, resulted in a 13% rise in the bottom line to $3.86 on an adjusted basis.

Coming to the latest quarter, we expect revenues to be around $22.2 billion, reflecting a 1% y-o-y rise and slightly ahead of the consensus estimate. FedEx has had a tough few quarters amid falling delivery volumes. The weakening consumer demand, given high inflation, has weighed on the overall package delivery volumes. However, it has seen market share gains lately, and it should aid the overall sales growth. The average daily volumes are also expected to stabilize after seeing weaker demand over the last year. FedEx should benefit from its cost-cutting initiatives in Q4. We estimate the bottom line to be $5.40 on an adjusted basis, reflecting 9% y-o-y growth.

Overall, we think FedEx will post an upbeat Q4, and it will likely have more positives to look forward to on the back of stabilizing volumes and margin expansion, boding well for its stock.

While FDX stock looks like it may see higher levels, it is helpful to see how FedEx’s Peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons.

| Returns | Jun 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| FDX Return | -2% | -2% | 33% |

| S&P 500 Return | 4% | 15% | 145% |

| Trefis Reinforced Value Portfolio | 4% | 8% | 666% |

[1] Returns as of 6/18/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates