How Are Expedia’s Different Segments Contributing To Its Growth?

Though it faced a few technical glitches which resulted in a setback of its Q2 2016 earnings results, Expedia seems to be on a growth track with its OTA platform leading the way. Expedia acquired big players including Travelocity, Orbitz, and HomeAway in 2015, which aided it in the consolidation of the U.S. OTA market. Currently the company has close to $70 billion in gross bookings over its 200 websites across 75 countries.

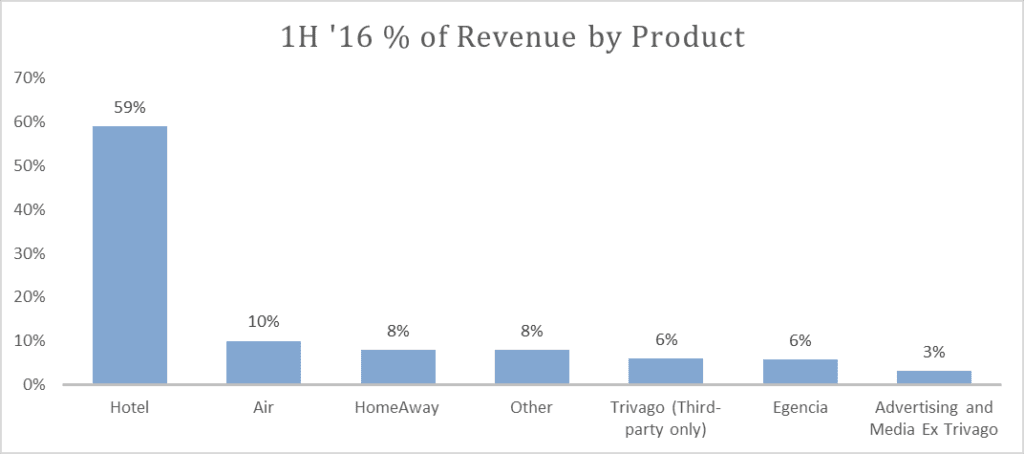

The OTA segment contributes to around 80% of Expedia’s revenues. Currently, HomeAway–the world’s largest vacation rental marketplace, contributes to around 8% of Expedia’s revenues, however that is expected to increase significantly in the future. Expedia’s metasearch arm Trivago is also growing impressively. Expedia’s advertising and media segment, where Trivago is the primary driver, is expected to grow at a CAGR exceeding 10% over the next 7 years. Expedia’s corporate travel arm, Egencia’s growth, currently exceeds that of the industry.

Expedia’s Segment-Wise Revenue Allocation For H1 2016 ($ Million, %)

(Source: Expedia Q2 2016 10Q )

In terms of products, hotels contribute around 60%, followed by the rest.

(Source: Expedia 2016 Q2 10Q Skift Estimates)

Editor’s Note: We care deeply about your inputs, and want to ensure our content is increasingly more useful to you. Please let us know what/why you liked or disliked in this article, and importantly, alternative analyses you want to see. Drop us a line at content@trefis.com

- Have more questions on Expedia? See the links below.

- What Drove Expedia’s Revenue And EBITDA Growth Over The Last Five Years?

- What Is Expedia’s Fundamental Value On The Basis Of Its Forecasted 2015 Results?

- Expedia Year 2015 Review

- How Have Expedia’s Different Segments Performed Over The Last Five Years?

- Expedia Q1 2016 Earnings Results

- How Does Expedia’s Financial State Currently Look?

- What Percentage of Expedia’s Stock Price Can Be Attributed To Growth?

- Who Relies More On Debt: Priceline Or Expedia?

- What Might Be The Long-Term Impacts Of Brexit On The Online Travel Agencies?

- Where Might Expedia Be Looking For Acquisition Opportunities Currently?

- Expedia’s Q2 2016 Earnings Preview

- Expedia’s Second Quarter Growth Was Undermined By Integration Issues Of Its Acquired Entities

- How Do We Expect Expedia’s Hotels Division To Trend?

- How Is Expedia’s Top Line Trending?

- Expedia’s Evolved Relationship With Marriott International And Its Significance

Notes:

1) The purpose of these analyses is to help readers focus on a few important things. We hope such lean communication sparks thinking, and encourages readers to comment and ask questions on the comment section, or email content@trefis.com2) Figures mentioned are approximate values to help our readers remember the key concepts more intuitively. For precise figures, please refer to our complete analysis for ExpediaRelevant Articles- Why Is Expedia Stock Up 24% This Year?

- Down 23% This Year, What Lies Ahead For Expedia Stock Post Q2 Results?

- Down 11% This Year, Will Expedia Stock Recover Following Q1 Results?

- Expedia Stock is Up 75% Since 2023. Where Is It Headed Post Q4?

- What To Expect From Expedia’s Q3 After Stock Up 8% This Year?

- Can Expedia Stock Return To Pre-Inflation Shock Highs?

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)