Is Chipotle Undervalued?

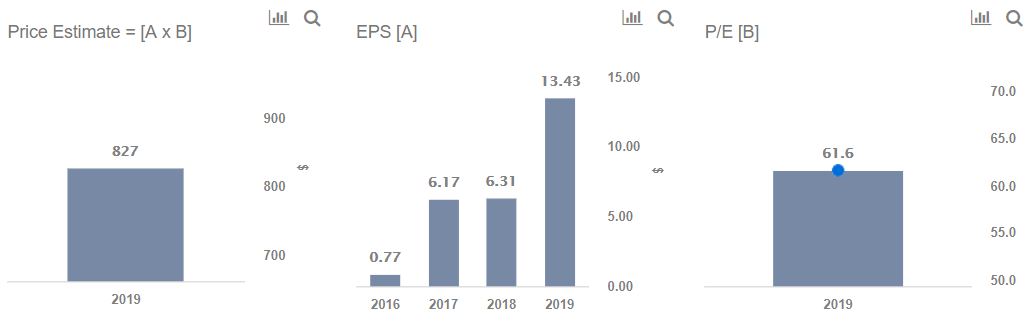

Yes, as per Trefis Price estimate Chipotle Mexican Grill (NYSE: CMG) valuation comes to $827 per share, higher than the current market price. Chipotle is a Mexican fast food restaurant that features a menu of burritos, burrito bowls (a burrito without the tortilla), tacos, and salads. The Chipotle restaurants are primarily situated in the US and are fully company owned and thus reported under a single segment. The industry is highly competitive with respect to taste, price, food quality and presentation, service, location, brand reputation, and the ambience and condition of each restaurant. In this note we discuss our stock price valuation for Chipotle. You can look at our interactive dashboard analysis ~ Chipotle’s Valuation: Cheap or Expensive? ~ for more details.

#1. Estimating Chipotle’s Total Revenues:

- How Did Chipotle Stock Gain 20% This Year Despite Inflationary Headwinds?

- Up 17% This Year, Will Higher Pricing Boost Chipotle’s Stock Post Q2 Earnings?

- Where Is Chipotle Stock Headed Post Stock Split?

- Chipotle Stock Is Up 39% This Year. What’s Happening With The Company?

- Rising 25% Year To Date, Will Q1 Results Drive Chipotle Stock Higher?

- Up 11% Already This Year, Does Chipotle Stock Have More Room To Run After Q4 Results?

- Total Revenues have increased from $3.9 billion in 2016 to $4.9 billion in 2018, and could grow 12.2% to $5.5 Billion in 2019. Our Interactive Dashboard Analysis, How Does Chipotle Make Money?, provides an in depth view of the company’s revenues.

#2. Deriving Chipotle’s Net Income:

- Net Income Margin has improved over the years primarily due to better operational efficiency. The margin improved from 0.6% in 2016 to 3.6% in 2018. Trefis estimates further improvement to around 6.9% in 2019.

- Due to better margins and higher revenues, Net Income grew from $22.9 million in 2016 to $176.6 million in 2018, and we expect it to be around $377.5 million in 2019.

#3. Determining Chipotle’s EPS:

- EPS has grown from $0.77 in 2016 to $6.31 in 2018, and we estimate it to be $13.43 in 2019.

- EPS growth from 2018 can be attributed to higher Net Income and lower Shares Outstanding.

#4. Estimating Chipotle’s Share Price:

- Our Price Estimate of $827 For Chipotle’s Stock is based on our Detailed Valuation Model, which implies a 61.6x P/E Multiple on expected 2019 EPS of $13.43

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.