Chipotle To End Fiscal Year 2018 On High Growth

Chipotle Mexican Grill (NYSE: CMG) has had an upbeat year in the first 3 quarters and is expected to post strong quarter 4 results for the Fiscal year 2018 on February 6, 2019 after the market closes. The investor call will take place at 4:30pm EST. In the first 3 quarters the company has done well on comparable sales improvement, net new stores opening, and margin expansion. We expect the trends to continue in the 4th quarter too. Chipotle continues to expect comparable sales to grow in the low-to-mid-single digits, and expects to open restaurants at around 130 locations this year. Looking ahead to 2019, Chipotle expects 140 to 155 new restaurant openings.

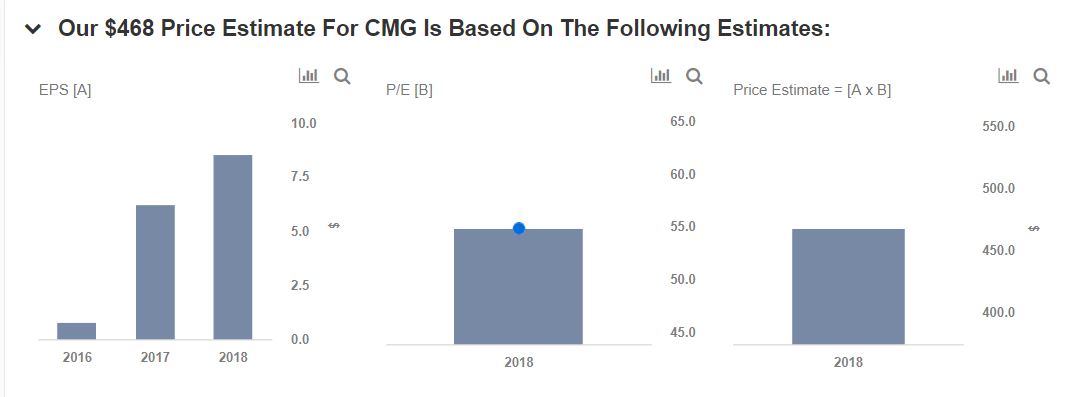

We have estimated CMG’s price to be $468. The charts have been made using our new, interactive platform. The various driver assumptions can be modified by clicking here for our interactive dashboard on Our Outlook For Chipotle in FY 2018, to gauge their impact on the earnings and price per share metric.

- How Did Chipotle Stock Gain 20% This Year Despite Inflationary Headwinds?

- Up 17% This Year, Will Higher Pricing Boost Chipotle’s Stock Post Q2 Earnings?

- Where Is Chipotle Stock Headed Post Stock Split?

- Chipotle Stock Is Up 39% This Year. What’s Happening With The Company?

- Rising 25% Year To Date, Will Q1 Results Drive Chipotle Stock Higher?

- Up 11% Already This Year, Does Chipotle Stock Have More Room To Run After Q4 Results?

Factors That May Impact Future Performance

- CEO Change: Brian Niccol joined CMG as its new Chief Executive Officer (CEO), effective from March 5, 2018. Niccol comes from Yum! Brands where he was the CEO of Taco Bell. He was instrumental in implementing a successful turnaround of that business. Niccol comes with strong expertise in digital technologies, restaurant operations, and brand building, and these skills are crucial for Chipotle’s turnaround. In the 2 quarters post his inculcation the company has done quite well.

- Accelerating Digital Sales: This is the fastest growing part of CMG’s business, with annualized digital sales exceeding $0.5 billion. This segment reported growth of 48% in the third quarter, and now represents 11.2% of the total sales of the company. By the end of 2018, CMG planned to accelerate the rollout of its digitally-enabled second make-lines to 1,000 restaurants, from 750 previously. These new lines enable a faster, and a more accurate experience for the digital customers, and allows CMG’s staff to more easily support the higher sales volumes. The company’s ‘Digital Pick Up Shelf’ initiative, which is now in 350 restaurants, not only provides a faster and a more convenient experience for mobile pick up orders, it also serves as an in-store marketing tool to raise awareness among its customers that they don’t have to go through the line to pick up their orders.

- Adding Catering and Delivery: Catering forms roughly 1% of the total sales, and is a largely untapped opportunity for the company. CMG has expanded its delivery availability to 1,800 restaurants, and expects to reach 2,000 by the end of the year. The company has noted that mobile and delivery orders are in that $16 to $17 range, while the traditional check is roughly $12. Since the company’s delivery sales continue to grow at a fast pace, CMG intends to expand the number of delivery partners it works with.

- New Restaurant Openings: CMG opened 28 new restaurants in Q3 and expects to be at about 130 new openings for the full year. Moreover, the company has plans for a higher number of openings for 2019, as mentioned earlier. New restaurant openings can have a significant positive impact on the company’s revenues. Meanwhile, the company is also in the process of closing 55 to 65 underperforming restaurants.

- New Menu Items: The company is also testing a number of menu items in order to build a pipeline for future years. These include quesadillas, nachos, bacon, lemonade, and a Mexican chocolate milkshake, and limited time offers such as chorizos.

Overall the company is doing quite well with the new CEO, new stores, digital, and delivery initiatives. We expect the growth momentum to sustain in the last quarter of the Fiscal year 2018.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.