Key Trends Explaining Our $628 Price Valuation For Chipotle

The leader in the fast-casual segment, Chipotle Mexican Grill (NYSE:CMG) recently released its second quarter earnings report for the fiscal year 2014. Continuing the momentum of the first quarter, the company delivered impressive results, with net revenue rising to $1.05 billion, up 28.6% year-over-year, primarily driven by an increase of 17.3% in the comparable restaurant sales. Same store sales or comparable restaurant sales saw tremendous improvement due to the increased traffic and increased average spend per visit. [1]

Moreover, the net income rose 25.5% to $110.3 million, whereas restaurant level operating margins declined 30 basis points to 27.3% in the second quarter, primarily due to higher food and marketing costs, partially offset comparatively lower labor and occupancy costs. Diluted EPS for this quarter rose to $3.50, up 24% from same period last year.

We have a $628 price estimate for Chipotle, which is about 8% lower than the current market price.

- How Did Chipotle Stock Gain 20% This Year Despite Inflationary Headwinds?

- Up 17% This Year, Will Higher Pricing Boost Chipotle’s Stock Post Q2 Earnings?

- Where Is Chipotle Stock Headed Post Stock Split?

- Chipotle Stock Is Up 39% This Year. What’s Happening With The Company?

- Rising 25% Year To Date, Will Q1 Results Drive Chipotle Stock Higher?

- Up 11% Already This Year, Does Chipotle Stock Have More Room To Run After Q4 Results?

See Our Complete Analysis For Chipotle Mexican Grill

The fast-casual segment is a fresh and rapidly growing concept, positioned somewhere between fast food restaurants and casual dining restaurants. They provide counter service and offer more customized, freshly prepared and high quality food than traditional Quick Service Restaurants (QSR), all in an up-scaled and inviting ambiance with meals ranging from $8 to $15. Brands such as Chipotle Mexican Grill (NYSE:CMG), Panera Bread, Qdoba Mexican Grill and Baja Fresh are considered as the top restaurants in this category.

Increasing Customer Traffic

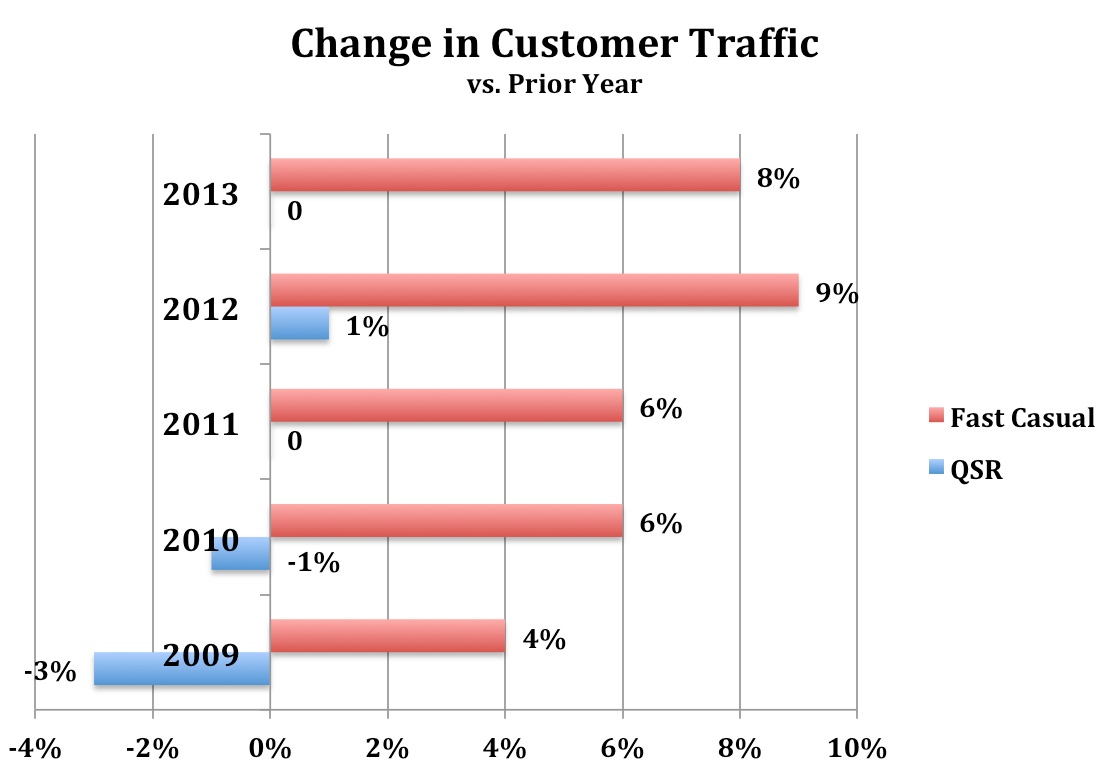

Big QSR brands such as McDonald’s, Subway and Starbucks have been facing a huge threat by the leading fast casual restaurants, as the traffic growth in the latter segment surpassed that of every other segment for the fifth consecutive year. [2] According to the NPD group, the fast casual segment saw an 8% rise in the guest count in the 12 month period ended in November last year, whereas traffic count was flat for quick service restaurants. This consumer shift is primarily due to the fact that people with higher disposable income are inclined more towards quality and hygienic food.

The average customer count per company-operated restaurant annually at McDonald’s, the leading brand in QSR segment, has been diminishing by 1.3% for two consecutive years, whereas for a successful fast casual restaurant such as Chipotle, the average guest count has been rising by 5% and 2.3% in the last two years.

source: NPD Group Survey [3]

source: NPD Group Survey [3]

Trefis Estimate

Trefis estimates the average number of annual visits per restaurant to rise by 4.5% in 2014. Recently, Chipotle introduced new innovative menu items including Sofritas-the new vegan tofu, which gained popularity among vegetarians, as well as non-vegetarians. Moreover, highly efficient service and different discounts & promotions might help in maintaining the customer base. However, after a point, it is really difficult to increase the customer visits as the customers avoid going to a restaurant which has long lines or no seating space. Thus, the only way to increase the footfall is by opening more restaurants. Taking into account that new store openings might slow down in pace in the coming years due to saturation, we have estimated the figure to decline gradually after 2015 and to reach 231,000 by the end of our forecast period.

Now, with more competitors entering the market every year and top fast food brands adapting to healthier food options, customers might shift to cheaper options. Moreover, further price hike in the menu might slow down the traffic growth. If the average annual visit per restaurant reaches only 212,000 by the end of our forecast period, we might see a 10% downside to our price estimate.

On the other hand, if the company accelerates its store expansion by venturing into international markets and if the customers continue to be unaffected by the price hike, we might see a little more growth in the average visits. If the average annual visit per restaurant reaches 250,000 by the end of our forecast period, we might see a 4% upside to our price estimate.

Revenue Growth To Accelerate

According to Technomic’s 2014 Top 500 chain restaurant report, sales for fast casual chains grew by 11% and store count by 8% in 2013. Although Chipotle generated $3.2 billion in revenues in 2013, which in comparison to McDonald’s seems to be a much smaller figure, the revenue growth has been consistently at around 20% for Chipotle for 5 years now.

Chipotle’s net revenue has increased by 75% over the last 3 years, with the average spend per customer visit rising 5.5% over the same period. On the other hand, fast food giants such as McDonald’s are finding it difficult to accelerate the revenue growth. McDonald’s revenue rose 17% over the last 3 years and average spend per visit increased 9% over the same period. Even though McDonald’s revenue are 9 times that of the Chipotle, the revenue growth for the fast-casual leader continues at a much faster pace, primarily driven by changing consumer preferences.

- Changing Dining Preferences

Chipotle believes that its extraordinary service and exceptional dining experience in addition to unique food culture hold the key for its improved comparable store sales. Additionally, the rising health concern among the people of the U.S. is one of the major reasons that fast casual restaurants are witnessing more traffic every quarter.

The company policy of ‘food with integrity’, where it focuses on serving naturally raised meat and fresh ingredients, have struck a chord with consumers and is forcing other restaurant chains to remodel their strategy and supply chain in order to respond to this newly created demand. As a result, people with higher disposable income are inclined more towards quality and hygienic food.

- Menu Price Hike in 2014

Chipotle initially decided to raise its menu prices in 2013, but refrained from doing so and deferred the move to 2014. In the second quarter, the company was forced to raise the prices of its steak burritos by 4%-6%, or 32-48 cents, whereas the overall menu prices went up by 6.5% on average and all this without hurting the customer traffic. Many feared that the price hike would affect the company’s customer traffic, but it had minimal impact on them. [4] People are willing to pay 4-5% extra for hygienic and better quality food. This led to an increase in the average spend per customer visit.

Trefis Estimates

Trefis has already accounted for the incremental revenue to be generated by the price hike in 2014 and thus estimates the average spend per visit to increase by 3% by the end of 2014, considering customer traffic is unaffected. We also believe that this growth might witness a gradual decline in the following years as the increasing competition would put a pressure on the pricing power of the company and customer traffic might witness a decline as more competitors come into the picture.

Chipotle’s prices are already among the highest in the segment. Further price hikes might result in a decline in customer count, which might slow down the revenue growth. In that case, average spend per visit might witness a slower growth of only 2% in 2014 and a gradual decline thereafter. As a result, we might see a 7.5% decline in Trefis’ price estimates.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes: