Why A China Unicom – China Telecom Merger Still Remains Unlikely

Reports of a merger between China Unicom (NYSE:CHU) and China Telecom (NYSE:CHA) resurfaced last month, with Bloomberg reporting that the Chinese government was exploring a potential merger of the nation’s second- and third-largest wireless carriers. A potential deal is expected to be driven primarily by the country’s ambitions of dominating the next-generation 5G mobile networks, which are currently being deployed in the U.S. While both companies indicated that they were not aware of a merger, with Bloomberg also indicating that a merger was far from certain, it could be helpful to look at what a potential could mean for the carriers and the broader Chinese wireless industry.

Our interactive dashboard analysis on the outlook for China Telecom over 2018 details our expectations for the carrier for the rest of this year. You can modify any of our key forecasts and assumptions to gauge the impact of changes on the company’s performance.

5G Is Expected To Be The Biggest Driver Of Any Possible Deal

- Is The Market Undervaluing Chinese Telcos: A Comparison With Verizon & AT&T?

- How Are Regulatory Directives Hurting China Telecom’s Revenues?

- A Closer Look At China Telecom’s Key Revenue Streams

- How Has China Telecom’s Wireless Business Fared Versus Rivals?

- What To Expect As China Telecom Reports Q1 Results

- Key Takeaways From China Telecom’s 2018 Results

China is looking to become a leader in the global deployment of 5G technology, which promises to offer high-speed wireless broadband networks that are significantly faster than 4G LTE, connecting everyday objects and devices to real-time data collection networks. The U.S. is currently ahead in this race, with major wireless carriers beginning some level of commercial 5G deployment this year, while China is only expected to begin commercial applications by 2020. However, the Chinese government is taking the technology very seriously, as it is expected to be instrumental in enabling the next generation of technologies including remote surgery, driverless automobiles, and traffic regulation. The cost of 5G deployment is likely to be very high, and Nomura estimates that China could have to spend as much as RMB 1.4 trillion (about $200 billion) over five to seven years on infrastructure, marking a 70% increase over what it spent on 4G services. If Unicom and Telecom merge, they could save a significant amount on capital expenditures by reducing the duplication of their network buildouts. Moreover, they could build a stronger and wider network that serves their customers better than they would be able to individually.

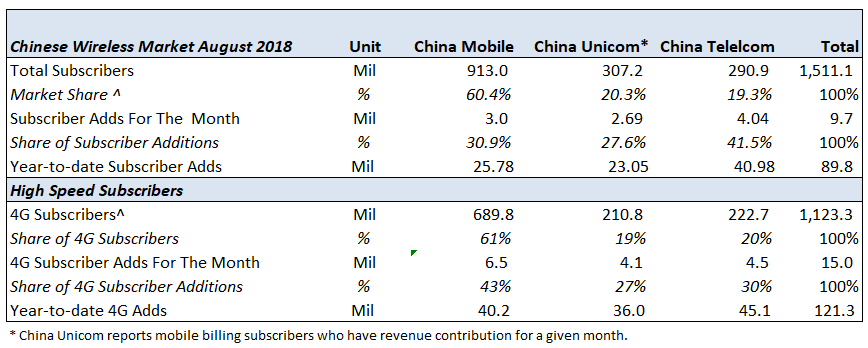

Why The Deal Is Far From Certain

That said, there could be some issues as well. The Chinese government has been promoting competition among state-backed firms over the last several years in order to make them more consumer-friendly and innovative, and a merger could damage this narrative since it would effectively create a duopoly in the wireless market (~60% market share for China Mobile and ~40% for a merged entity). Additionally, both companies are listed publicly, and for a merger to add meaningful shareholder value, there would need to be significant operating expense reductions, particularly on the employee front. This would require large-scale job cuts, which is something that the government may not be open to, considering the potential social impact. Moreover, it’s possible that the carriers could achieve a lot of benefits without actually merging. The two companies already collaborated to an extent on their 4G base stations, and it’s possible that they could continue to collaborate in building out 5G as well.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own