With The Stock Flat This Year, Will Q1 Results Drive Booking Holdings’ Stock Higher?

Booking Holdings (NASDAQ: BKNG), the world’s largest online travel agency, that offers services from lodging to airline tickets to car rentals, is scheduled to announce its fiscal first-quarter results on Thursday, May 2. We expect the company’s stock to likely see little to no movement with revenues and earnings matching market expectations. Booking Holdings has fully recovered from the difficult period caused by the pandemic. Travel and experiences drove U.S. consumer spending in 2023, resulting in a solid rise of 75% for BKNG stock in 2023. However, the company’s stock is flat so far this year. There is optimism among consumers due to the low unemployment rate and the anticipated fed rate cuts, but there are concerns due to layoffs at major companies. The ongoing conflict in the Middle East dampened room reservations during the holiday season and is expected to impact Q1 negatively, as well. Currently, the company is also involved in some legal battles, including a $530 million fine from the Spanish government.

BKNG stock has seen extremely strong gains of 60% from levels of $2225 in early January 2021 to around $3515 now, vs. an increase of about 35% for the S&P 500 over this roughly 3-year period. However, the increase in BKNG stock has been far from consistent. Returns for the stock were 8% in 2021, -16% in 2022, and 76% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 24% in 2023 – indicating that BKNG underperformed the S&P in 2021.

In fact, consistently beating the S&P 500 – in good times and bad – has been difficult over recent years for individual stocks; for heavyweights in the Consumer Discretionary sector including AMZN, TSLA, and TM, and even for the megacap stars GOOG, MSFT, and AAPL. In contrast, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index; less of a roller-coaster ride as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could BKNG face a similar situation as it did in 2021 and underperform the S&P over the next 12 months – or will it see a strong jump?

(1) Revenues expected to come in line with the consensus estimates

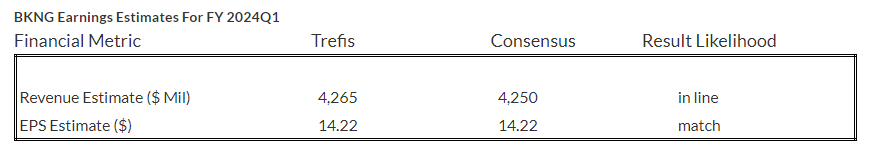

Trefis estimates Booking Holdings’ Q1 2024 revenues to be around $4.3 Bil, matching the consensus estimate. In Q4 2023, the online travel agency’s revenues grew 18% year-over-year (y-o-y) to $4.8 billion, driven by a 16% y-o-y increase in gross bookings to $31.7 billion. Gross travel bookings refer to the total dollar value, generally inclusive of taxes and fees, of all travel services booked by the customers, net of cancellations. Room nights booked increased 9% in Q4 from the prior-year quarter, rental car days were up 11% y-o-y, and airline tickets booked jumped 46% y-o-y in Q4. Room nights booked in the quarter grew 15% y-0-y in Q3 2023, so the company saw a decelerating trend quarter-over-quarter in Q4, largely due to the conflict in Israel. The company notes that room nights would have grown 11% y-o-y when adjusted for this. BKNG still expects this growth rate to decelerate further, as its Q1 outlook calls for a 4%-6% y-o-y growth in room nights booked.

- What’s Next For Booking Holdings’ Stock After An Upbeat Q4?

- How Might Booking Stock React To Upcoming Earnings?

- What’s Happening With Booking Holdings’ Stock?

- With The Stock Up 5% This Year, Will Q2 Results Drive Booking Stock Higher?

- What To Expect From Booking Holdings’ Q4 After Stock Up A Strong 84% Since 2023?

- Up 36% This Year, Will Booking Holdings’ Stock Rally Further Following Q3 Results?

For the full-year 2024, we expect Booking Holdings revenues to grow 18% y-o-y to $25.2 billion.

(2) EPS likely to match the consensus estimates

Booking Holdings’ Q1 2024 earnings per share (EPS) is expected to come in at $14.22 as per Trefis analysis, in line with the consensus estimate. BKNG earned a profit of $32.00 in Q4, an increase of 29% from the prior-year quarter. The company notched $1.46 billion in adjusted EBITDA in Q4, up 18% y-o-y – in line with revenue. Adjusted EBITDA margins remained roughly flat y-o-y at 30.6%. The company is ramping up non-hotel products like flights and rental car bookings to capture more of customers’ wallet share.

(3) Stock price estimate in line with the current market price

Going by our Booking Holdings’ Valuation, with an earnings per share estimate of around $174.48 and a P/E multiple of 21.1x in fiscal 2024, this translates into a price of $3675, which is in line with the current market price.

It is helpful to see how its peers stack up. BKNG Peers shows how Booking Holdings stock compares against peers on metrics that matter. You will find other useful comparisons for companies across industries at Peer Comparisons.

| Returns | Apr 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| BKNG Return | -3% | -1% | 140% |

| S&P 500 Return | -3% | 7% | 129% |

| Trefis Reinforced Value Portfolio | -4% | 2% | 625% |

[1] Returns as of 4/30/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios