Best Buy Rides Higher Comparable Sales To Solid Q4

Best Buy‘s (NYSE:BBY) announced solid fourth quarter results, as both its revenue and earnings per share came in ahead of market expectations. In Q4, Best Buy’s revenue grew 14% year-over-year (y-o-y) to around $15.4 billion, largely due to an enterprise comparable sales increase of 9%, which beat expectations of 3.0%. The company benefited from stronger consumer demand across all major categories. The retailer’s online sales grew to $2.8 billion, which is now 20% of its domestic revenue. Best Buy also reported non-GAAP EPS of $2.42 in this quarter, up 25% y-o-y, primarily driven by a lower than tax rate and a higher domestic revenue. The company’s SG&A costs grew 20% y-o-y, due to increases in growth investments, higher incentive compensation expenses, and higher variable costs due to increased revenue.

We have created an Interactive Dashboard which outlines the company’s Q4 performance and our expectations for its fiscal 2019 results. You can modify our forecasts to see the impact any changes would have on the company’s earnings and valuation.

- With Q2 Earnings Around The Corner, Will Best Buy Stock Live Up To Its Name?

- Down 7% This Year, Will Best Buy Stock Recover Following Q1 Results?

- Flat Since The Beginning of 2023, What’s Next For Best Buy’s Stock Post Q4 Results?

- Down 15% This Year, Where Is Best Buy Stock Headed Post Q3?

- What To Expect From Best Buy’s Stock Post Q2?

- What’s Happening With Best Buy’s Stock?

Best Buy U.S. Continues To Grow

Best Buy’s domestic segment’s revenue increased 13% y-o-y to $14 billion, as domestic comparable sales grew 9%, partially offset by the loss of revenue from the closure of 18 large-format stores. From a merchandising perspective, the company saw positive comps across most of its product categories, with the largest drivers being mobile phones, gaming, appliances, smart home, wearables and home theater. In the international segment, the company’s revenue increased 20% y-o-y to $1.4 billion, driven by comparable sales growth of 9.9%. This positive comparable growth was driven by growth in both Canada and Mexico.

Future Outlook

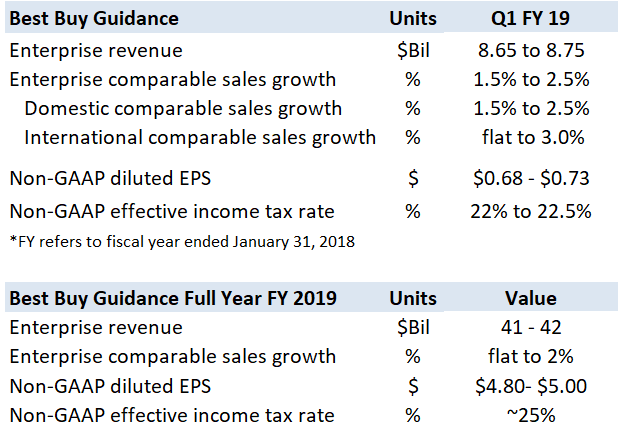

For the fourth quarter, Best Buy expects its total revenue to be in the range of $8.65 to $8.75 billion. It also expects domestic comparable sales growth in the range of 1.5% to 2.5%, and adjusted earnings per diluted share of $0.68 to $0.73 for the company. For the full year fiscal 2019, the company expects revenue to range between $41 to $42 billion.

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own