Here’s Why We Revised Bed Bath & Beyond’s Price Estimate To $25

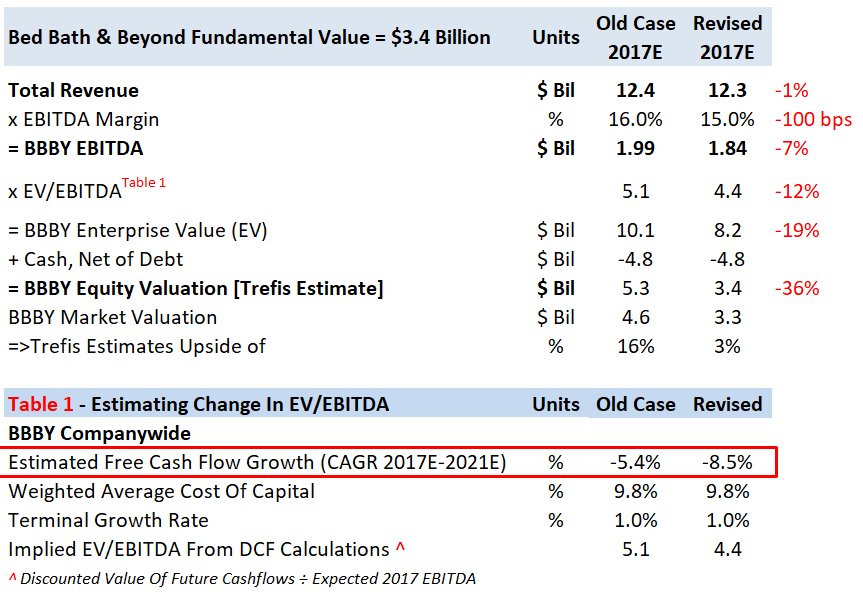

We recently revised our price estimate for Bed Bath & Beyond (NASDAQ: BBBY) downward from $37 to $25. The primary reason for the price estimate revision was a lower revenue expectation due to a continuous decline in the company’s comparable sales growth. While comparable sales from the company’s customer-facing digital channel continue to see strong growth in excess of 20%, comparable sales from its stores have been steadily declining in the mid-single-digit percentage range. Additionally, the company continues to see margin pressure, both in terms of operating and gross margins, due to increased expenses owing to an increase in salary compensation and technology-related costs. Accordingly, we have adjusted our forecasts to reflect the current trends.

- What To Expect From Bed Bath & Beyond’s Stock Post Q1 Results?

- Down 54% in Six Months, What’s Next For Bed Bath & Beyond Stock?

- Bed Bath & Beyond Up 53% In A Month, What’s Next?

- Overstock.com’s Stock Rose 36% In The Last Month, Will The Rise Continue?

- Can Bath & Body Works Stock Rebound After A 23% Fall In a Month?

- Can BBBY’s Stock Trade Higher Post Q3 Results?

Bed Bath & Beyond started the year on a weak note, as the company’s 2017 performance thus far has been mostly below its guidance and market expectations. In fact, post-Q2 earnings, the retailer’s stock reached a 52-week low of $22.10 per share, and the company’s stock is now trading 45% lower than its price at the beginning of the year. To add to that, the company revised its full-year guidance after the weaker-than-expected fiscal first half of 2017. It now expects net sales to be relatively flat, as it plans to spend on organizational changes and transformational initiatives going forward. The retailer also expects comparable sales to decline compared to the slightly positive previous guidance. In addition, the company expects net earnings per diluted share for the full-year to be around $3 compared to a previous expectation of $4. Correspondingly, we have incorporated the changes to our model to better reflect future revenues and margins.

Our price estimate for Bed Bath & Beyond’s stock is slightly higher than the current market price. You can modify the interactive charts in this article to gauge the impact changes in individual drivers for Bed Bath & Beyond can have on our price estimate for the company.

Have more questions about Bed Bath And Beyond? Please refer to our complete analysis for Bed Bath & Beyond

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)