At $5, BlackBerry Is An Attractive Acquisition Target

BlackBerry (NYSE:BB) stock has declined by ~45% over the last six months to levels of around $5 per share. There are a couple of trends driving the decline. Firstly, the company’s Cylance business – which it acquired for $1.4 billion earlier this year- could be underperforming, with revenues standing at $67 million over the first half of the fiscal year. For perspective, Cylance had revenues of ~$130 million in CY’18, posting revenue growth of 90%, and BlackBerry had guided a growth of as much as 30%, implying that BlackBerry is not able to scale-up the business. Moreover, over Q2, the company missed earnings estimates and also cut the top-end of its revenue forecast for the full year. That said, we believe that the company could be undervalued at these levels, making it an attractive acquisition target.

View our interactive dashboard analysis on Why BlackBerry Could Be An Attractive Acquisition Target At These Price Levels

BlackBerry Has Been Taking A Long Time To Transform Its Business, Hurting Investor Sentiment

The company has been taking time to transform its business, with revenues dropping from $2.2 billion in FY’16 to under $1 billion in FY’19.

It is possible that the markets are losing patience, leading the stock to post a sharp decline to any negative news.

However, There Are Many Positives Working In BlackBerry’s Favor

1. BlackBerry Could See Meaningful Upside In The Automotive Market

- BlackBerry has had a presence in the automotive market for a while now, supplying its QNX operating system for automotive infotainment systems and connected cars.

- The installed base for QNX has risen from 60 million units in 2016 to over 150 million in 2019.

- The company is expanding into higher-value areas such as driver assistance systems, instrument clusters, and domain controllers, while also testing self-driving software.

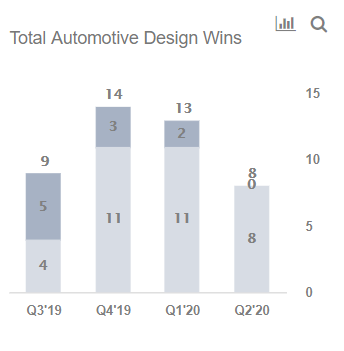

- An increasing mix of its design wins for QNX are coming from the Non-infotainment market.

- In Q2’19, all 8 automotive design wins were non-infotainment, compared to 5 infotainment and 4 non-infotainment in Q3’19.

- The revenue base of the Technology Solutions business – which derives much of its revenues from these automotive bets – has grown from $134 million to $204 million last fiscal year.

The Market For Vehicle Software Is Expanding Fast

- Overall software content per vehicle is expected to grow from $1200 in 2018 to over $5000 by 2030, per McKinsey, and this is a trend that could benefit BlackBerry.

2.BlackBerry’s Intellectual Property Could Be Valuable

- BlackBerry has roughly 44,000 patents and the company has been increasingly monetizing its IP, with Licensing related revenues rising from $150 million to $286 million.

- Much of the company’s IP is geared toward foundation technologies in the mobile communication space, where lawsuits over basic technologies have been common in the past.

3. BlackBerry’ s Valuation Looks Attractive At These Levels

- BlackBerry trades at just about 2.6x projected 2020 revenues, with a market cap of under $3 billion.

- While this is partly due to the company’s declining revenue base, BlackBerry has turned around its operations and remains profitable.

- The company’s P/S multiple also remains well below its peers.

- For instance, endpoint security company Carbon Black is being acquired by VMWare at a deal valued at over 8x its projected 2019 revenues.

- Mobile Iron, another rival in the device management space trades at over 3x revenues.

Conclusion

- Overall, BlackBerry could be attractive at these price levels, given its significant intellectual property and its growing focus on automotive software and security solutions, which could be increasingly valuable in an era of connected and self-driving cars.

- Potential acquirers could include automakers, large technology companies, and device manufacturers as well as other software players who are looking to increase their exposure to the security software space.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.