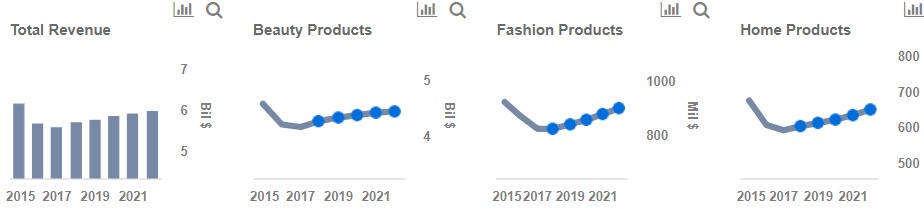

Will Representatives Growth Drive Avon’s Q4 Earnings?

Avon (NYSE: AVP) is slated to announce its Q4 earnings on February 14. During the Q3 earnings Avon’s total revenue marginally increased to $1.4 billion, up by 1% on a y-o-y basis, as compared to the same period last year, due to recent growth initiatives taken up by the Company. There was also an impact of adopting the new revenue recognition standard required by generally accepted accounting principles in the United States (“GAAP”). Avon experienced a decline in Active Representatives and Ending Representatives. Each declined 5% and 6%, respectively, excluding the Brazil truckers’ strike. Avon’s bottom line remained dampened as it experienced continued variability with challenges in key markets, particularly Brazil, where it was facing bad debt, challenges with representative retention, as well as stiff competition from other players.

On the brighter side, the company remains on track with the Transformation Plan that targets achieving cost savings of $65 million in 2018, of which $44 million was reached in the third quarter. They also completed the early redemption of their 2019 bonds to reduce their debt and further strengthen their balance sheet.

With the recent inductions made in Avon’s top management, the company is positive that injecting new talent and capabilities into the business will steer Avon toward the path of growth. Looking ahead in Q4, the company is focused to generate efficiencies, boosting their Representatives growth, and striving to strategically redirecting investments to support underlying growth initiatives.

- How Coty Benefits From Recent Divestment & Deleveraging Plans

- Synergies From The Avon-Natura Merger Could Unlock More Than $1 Billion In Value For Shareholders

- What Does The Avon-Natura Merger Deal Mean For Investors In Avon?

- A Closer Look At Avon’s Global Operations, And What’s In It For Natura

- Key Takeaways from Avon’s Q4 Earnings

- What Are the Factors That Would Drive the Revenues and Earnings of Avon In the Next 2 Years?

Please refer to our dashboard analysis on What to expect from Avon’s Q4 Earnings. In addition, all Trefis Consumer Discretionary Data is here.

Below we discuss the main focus areas that will likely help Avon in reviving growth in the upcoming Q4 2018 results:

Geographic And Brand Focus – Avon’s Q3 revenues were up by 1% y-o-y in Europe, Middle East & Africa (EMEA), however were down by 8% in South Latin America, where Brazil suffered an outsized impact from the trucking strike. In North Latin America, revenues were relatively unchanged, while the Asia-Pacific division’s revenue was down by 1%. A similar trend was observed in the company’s Ending Representative figures across geographies. Active Representatives and Ending Representative declined 4% each, driven by decreases in South Latin America, primarily Brazil, Europe, Middle East & Africa, and North Latin America, but primarily hit by the Brazil truckers’ strike.

A similar trend was observed in the company’s Ending Representative figures across geographies. Active Representatives and Ending Representative fell 5% and 6%, respectively, with a decline in both the Representatives across each of the company’s segments. Although management is focused on boosting Representatives growth, increased costs toward reviving its direct selling business model are denting margins. Along with its markets, Avon has also decided to focus on around 40 of its top brands that contribute about 80% of its growth. It has segregated its brands under three tiers: Upper Mass, Mass, and Value. It is also focused on gathering analytical data on each representative’s business and working toward improving their representatives’ experience. Avon has also been making significant improvements in servicing the Representatives by improving delivery and services at its distribution centers. While these growth initiatives raise optimism, soft Representatives growth and higher spending remain major concerns in the fourth quarter.

Short Term And Long-Term Financial Goals – Enabled by these strategies, the company plans on driving out cost, improving financial resilience, and investing in growth over the next three years. Its long-term financial goals include: mid-single-digit constant dollar revenue growth and a low double-digit adjusted operating margin. All in all, the company remains committed to its cost-saving endeavors to drive margins.

Digital Initiatives – The company is focusing on digital and e-commerce initiatives. Avon’s social media presence has increased, with it having the third largest fan following among beauty brands. Along with increasing investments on advertisements, the company is shifting many of its campaigns to the digital platform. In our view, this will positively impact its performance as an increasing number of customers are buying beauty products online.

The company is focused to generate efficiencies, and will strive to improve on the above trends in FY2019 by strategically redirecting investments to support its underlying growth initiatives.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.