Abercrombie & Fitch Stock To Trade Lower Post Q4?

Abercrombie & Fitch (NYSE: ANF), a specialty retailer selling casual clothing and footwear, is scheduled to report its fiscal fourth-quarter results on Tuesday, March 2. We expect ANF to trade lower due to weak fiscal Q4 2021 results with revenues as well as earnings missing consensus. While the digital transition and cost-cutting initiatives are looking good for the retailer’s margins, the top-line decline remains a key issue in the near term.

Our forecast indicates that ANF’s valuation is around $25 a share, which is almost 10% lower than the current market price of roughly $27. Look at our interactive dashboard analysis on ANF‘s Pre-Earnings: What To Expect in Q4? for more details.

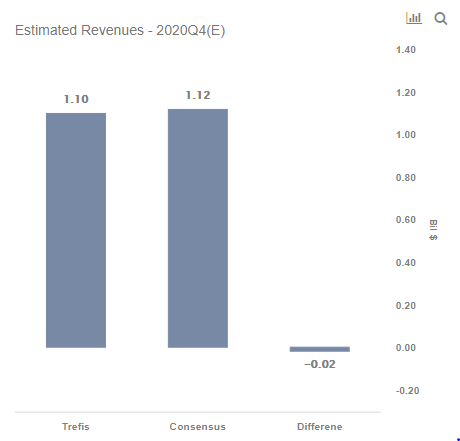

(1) Revenues expected to be below consensus estimates

- Abercrombie Reports Strong Q2 Beat, Yet Its Stock Tanks 17%: What’s Going On?

- Can A Strong Q2 Performance Help Abercrombie Stock Extend Its 80% Gains This Year?

- What’s Next For ANF Stock After 47% Gains In A Month?

- Is F5 Stock A Better Pick Over Abercrombie After Its Recent 20% Rise?

- Up 70% Since Beginning of This Year, Will Abercrombie’s Strong Run Continue Following Q1 Results?

- Up 5x Over The Last Twelve Months, Where Is Abercrombie & Fitch Stock Headed?

Trefis estimates ANF’s Q4 2021 revenues to be around $1.10 Bil, 2% below the consensus estimate of $1.12 Bil. In the first nine months of 2021, the company’s revenues declined 18% year-over-year (y-o-y), including a 19% drop in sales of the company’s Hollister brand, and a 17% drop in sales of Abercrombie. In addition, its digital net sales jumped 42% during the same period. With a furloughed workforce and reduced occupancy expenses, Abercrombie & Fitch counterintuitively gained some leverage thanks to these strong e-commerce sales. Going forward, we expect the surging coronavirus cases and likely longer-term traffic declines across malls to continue to pressure on ANF’s revenues in the upcoming Q4.

The company revised its fourth-quarter forecasts upward from a 5% to 10% dip in sales compared to Q4 2019, to a 5% to 7% drop in a recent update. The company commented that the improvement reflects an ongoing digital momentum that has partially offset the store closures and capacity restrictions in North America and EMEA (Europe, Middle East, Asia) regions. For the full-year, we expect ANF’s revenues to decline 14% y-o-y.

2) EPS also likely to be below consensus estimates

ANF’s Q4 2021 earnings per share (EPS) is expected to be $1.18 per Trefis analysis, 2% below the consensus estimate of $1.21. The company reported a net income of $42.3 million, or $0.68 per diluted share in Q3. This was a sharp improvement from last year when it reported only $6.5 million of net income. It should be noted that the company reported earnings at a loss of $3.14 per share compared to -$0.67 in the first nine months of fiscal 2020.

(3) Stock price estimate lower than the current market price

Going by our ANF Valuation, with a revenue per share (RPS) estimate of around $49.00 and a P/S multiple of 0.5x in fiscal 2020, this translates into a price of $25, which is almost 10% lower than the current market price of roughly $27.

While ANF stock could go down post Q4, 2020 has created many pricing discontinuities that can offer attractive trading opportunities. For example, you’ll be surprised how counter-intuitive the stock valuation is for Amazon vs Etsy.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams