Part 2: Is There A Way Out Of The Rut For Brick And Mortar Stores?

A number of retailers, including Macy’s, Barnes & Noble, and Sears, delivered disappointing holiday sales results. Women’s apparel retailer The Limited reported it will close down its 250 brick and mortar stores. Retail bigwig Walmart disclosed its decision to cut hundreds of jobs by the end of the month. The thing all these have in common is their brick and mortar business. All these stores have suffered as a result of the move to online business. In the second part of this series, we give other factors which have hampered the growth of this retail channel.

The Rise Of Online Shopping

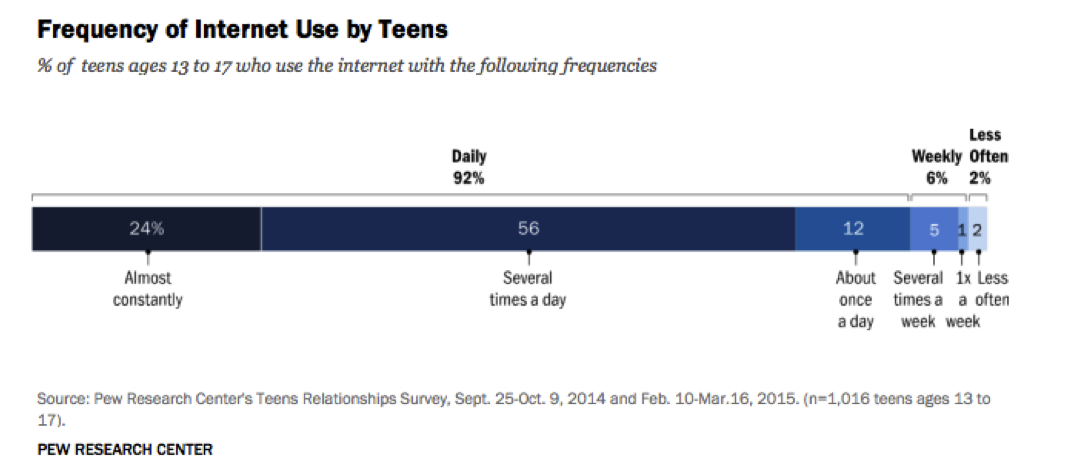

With growing Internet penetration, a consistent customer shift from store to web shopping, and the proliferation of smartphones and tablets, the growth in online shopping has been massive. Online retail sales in the U.S. have grown at a rapid pace over the past several years, thanks to growing Internet usage in the country; internet penetration in the U.S. has gone up from 44% in 2000 to 88.5% currently. Furthermore, facilitated by the convenience of constant access, 92% of teens today go online daily, including 24% who are online constantly, according to a study conducted by Pew Research Center. Over half of the teens (aged 13 to 17 years) go online several times a day, aided by the presence of smartphones, which is available to nearly three-quarters of teens. The smartphone usage will only increase in the future, and this will likely result in a steady rise in online sales. This is evidenced by research which predicts online apparel sales in the US to increase its revenue from $63 billion in 2015 to $100 billion by 2019. This segment is considered as the most popular e-commerce category in the US, accounting for 17.2% of total e-retail sales in 2015.

The U.S. apparel industry is gradually shifting toward omni-channel retailing, which refers to providing a seamless shopping experience across stores and the online channel. This is becoming an inevitable move for U.S. apparel retailers, including American Eagle, which is working hard to develop its omni-channel platform and has shown significant progress so far. The company’s digital sales registered a 20% growth in FY 2015. This lends credence to its decision to develop its omni-channel presence by investing in digital marketing, and improve its website and mobile app.

In a stark contrast to weak holiday sales by brick and mortar stores, online sales during the holiday season, from November 1 to December 31, totaled $91.7 billion, according to the latest numbers by Adobe Insights, representing an 11% growth year-on-year. Of the 61 shopping days, 57 of them generated sales topping $1 billion. Among the online retailers, Amazon poses the biggest threat to the stores. Financial services firm Cowen and Company predicts the online giant will overtake Macy’s as the biggest US apparel retailer this year. Unlike specialty retailers, Amazon caters to many different price points, all the way from cheap t-shirts up to luxury items.

Dependence On Discounts

A highly promotional environment has plagued many apparel retailers, making customers accustomed to discounted merchandise. With a steadier economy at present, many retailers are trying to push back from their discount-driven past. However, it may not be as easy, since the shoppers seem to be hooked on to deals. Affordable luxury brand Ralph Lauren (NYSE:RL) has also made an attempt to cut down its average sale period by 30%, and decrease the depth of its markdowns. During its fourth quarter and financial year 2016 (ended June), Coach (NYSE:COH) announced its decision to pull the company’s handbags and leather goods out of 25% of department stores, or by over 250 locations; a move which is specifically designed to protect its luxury brand image. Furthermore, the company intends to reduce the markdown allowances to the channel, citing a highly promotional environment embraced by such stores. The heavy discounts offered in this channel makes it harder for consumers to spend more on a similar bag at the company’s own stores or its e-commerce websites.

Michael Kors, which generates about 40% of its sales from its wholesale locations, is also reducing the amount of merchandise it sells through the channel. Kate Spade, which is still building out its wholesale network as it is a much smaller brand, is also taking a careful and cautious approach. Since outlet stores are usually located in tourist locations, they’ve been hit particularly hard, as a strong dollar has hit the tourist inflow into the US.

For the first part of the series, click on the link below:

- Abercrombie Reports Strong Q2 Beat, Yet Its Stock Tanks 17%: What’s Going On?

- Can A Strong Q2 Performance Help Abercrombie Stock Extend Its 80% Gains This Year?

- What’s Next For ANF Stock After 47% Gains In A Month?

- Is F5 Stock A Better Pick Over Abercrombie After Its Recent 20% Rise?

- Up 70% Since Beginning of This Year, Will Abercrombie’s Strong Run Continue Following Q1 Results?

- Up 5x Over The Last Twelve Months, Where Is Abercrombie & Fitch Stock Headed?

Notes:

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap |More Trefis Research