Ameritrade’s Strong Growth In Key Metrics Continued In August

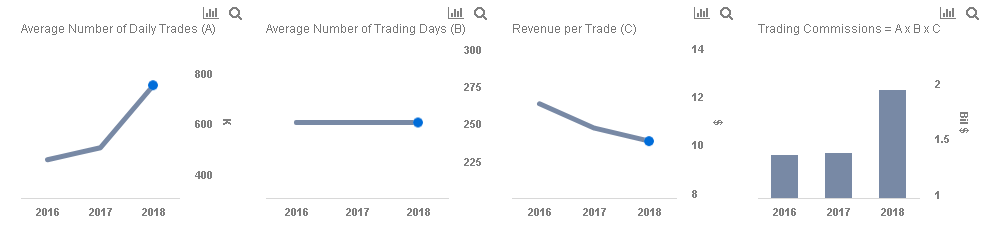

In continuation with a strong performance across its key metrics in the first 10 months of the fiscal year, TD Ameritrade (NASDAQ:AMTD) sustained its growth trend in August. The brokerage’s daily trading volumes grew by nearly 55% year-over-year, and given that the company generates over 40% of its revenue from trading commissions, it needs to sustain this growth in order to compensate for the price cuts in commissions announced earlier in the year. However, the brokerage’s acquisition of Scottrade should offer some respite and help in offsetting price-based competition from zero- and low-fee brokerages such as Robinhood. Further, the acquisition will boost the brokerage’s customer and asset base growth in the near future.

We have a $56 price estimate for Ameritrade’s stock, which is about in line with the current market price. Our interactive dashboard shows historical trends highlighting Ameritrade’s strong growth in key metrics; you can modify our forecasts for the asset base, yield on assets and other key metrics to assess their impact on the company’s total revenues.

- Coronavirus Recovery Watch: Capital Market Portfolio: 15% 5D Return vs. (-25%) YTD Return – [BlackRock, E*TRADE, Schwab & TD Ameritrade]

- Why Isn’t Charles Schwab’s Stock Benefiting From The Spike In Trading Volumes?

- How Would Zero Trading Commissions Impact TD Ameritrade Revenues In 2020?

- What Would The Combined Charles Schwab-TD Ameritrade Look Like?

- Is TD Ameritrade’s Fiscal 2020 Revenue Guidance Too Optimistic?

- Did Interest Income Gains Offset Lower Trading Commissions For TD Ameritrade In Fiscal Q3?

Asset Base Growth

Interest-earning assets, which contribute around 50% of Ameritrade’s total revenues, were up by slightly under 22% from the previous year’s comparable period. This improvement in volumes is likely driven by rate hikes over the past few months as well as capital appreciation. This trend is likely to continue in the near term, as we expect further rate hikes in the year ahead. Further, the Scottrade acquisition helped drive nearly 56% growth in the segment’s revenue.

Ameritrade’s assets under management (AUM) have also continued to grow, and the brokerage’s digital advisory business and focus on newer investment products are likely to drive further AUM growth, and consequently higher investment product fees. This should provide a boost to revenues moving forward, offsetting the aforementioned competitive pressure.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own