How Much Will American Eagle’s Revenue Grow In The Next 3 Years?

American Eagle Outfitters (NYSE:AEO) has seen solid growth in recent years. The company’s revenue grew by slightly over 4% annually, and its stock price increased by just under 12% between 2015-2017. We attribute this primarily to strong digital sales and solid comp sales growth across both American Eagle and Aerie brands. The Aerie brand has been the standout performer for AEO in the last few years, growing approximately 25% annually between 2015-17. Further, an increasing proportion of AEO’s sales comes from the Aerie brand, as it posted double-digit comps growth for the 16th straight quarter in Q3. Much of this robust growth was due to AEO’s ability to attract customers from its body-positive marketing campaigns. The company continues to focus on leveraging its leading brand position to expand its market share for the American Eagle brand, accelerating growth and expansion of Aerie, and elevating the customer experience. These factors should bode well for the company in the future, ensuring strong growth in the years to come. Below we take a look at what to expect from American Eagle’s Aerie brand in the next three years.

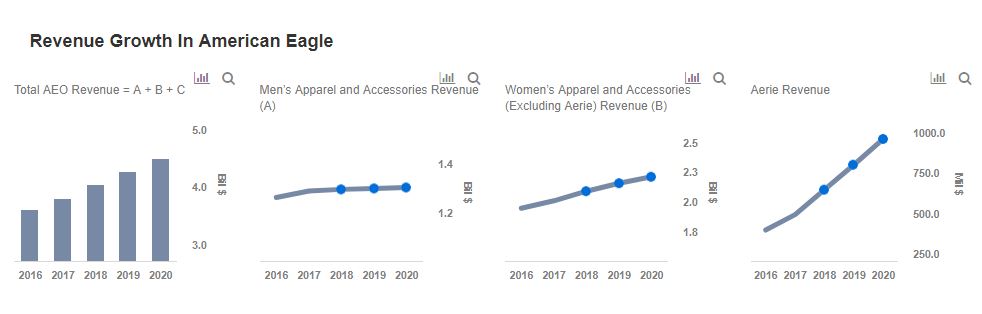

Based on robust growth of the digital segment and activewear potential, we expect American Eagle to report 5-6% annual revenue growth in the next three years, from $3.8 billion in FY 2017 to about $4.5 billion in FY 2020. We have summarized our expectations on our interactive dashboard, American Eagle’s Revenue Outlook For the Next 3 Years, through FY’18 and FY’20. If you disagree with our forecasts, you can change the key drivers for each segment to gauge how changes will impact its expected revenue. Below we take a look at the key drivers for the Aerie and Digital segments.

Based on robust growth of the digital segment and activewear potential, we expect American Eagle to report 5-6% annual revenue growth in the next three years, from $3.8 billion in FY 2017 to about $4.5 billion in FY 2020. We have summarized our expectations on our interactive dashboard, American Eagle’s Revenue Outlook For the Next 3 Years, through FY’18 and FY’20. If you disagree with our forecasts, you can change the key drivers for each segment to gauge how changes will impact its expected revenue. Below we take a look at the key drivers for the Aerie and Digital segments.

Factors That May Impact Future Performance

- What’s Happening With American Eagle Outfitters’ Stock?

- American Eagle Outfitters Q2 Earnings: What Are We Watching?

- Rising 9% This Year, What Lies Ahead For American Eagle Stock Following Q1 Earnings?

- Will Q4 Results Help Extend The 14% Gain In American Eagle Stock Since Beginning of This Year?

- American Eagle Stock Up 32% Over Last Twelve Months, What’s Next?

- Can American Eagle Stock Return To Pre-Inflation Shock Highs?

Potential of Aerie: American Eagle’s lingerie and activewear brand, Aerie, has been the company’s fastest-growing brand of late, with revenues growing nearly 25% annually between 2015-2017, reaching just under $500 million in 2017. The brand has consistently delivered comp sales growth due to enhanced consumer engagement and evolved shopping behavior. The brand grew by nearly 32% in the first nine months of 2018, driven by strong traffic trends, reduced promotions, and new launches. Further, the brand has seen impressive growth across clothing lines – core intimates, activewear, and apparel. American Eagle expects the brand to cross $1 billion in sales in the next couple of years, with most of this growth coming from its digital channel, which grew by double-digits in the first nine months 0f 2018. Looking ahead, Aerie remains poised for long-term growth as it continues to push through new ideas and fabrics and increasing its store count.

Strength Of Digital Segment: The growth of online and mobile shopping highlights the shift away from physical stores, and AEO has ensured that its presence is felt in this space. In Q3, AEO reported a 15th consecutive quarter of double-digit growth in its digital segment, with digital penetration expanding to 27% of revenue. Much of this growth was largely due to increased traffic coming from its app and mobile channels, which together represent roughly half of the retailer’s digital business. AEO continues to invest in technology and its omnichannel capabilities, which should not only improve customer engagement and enhance consumer experience, but also ensure sustained growth from the segment.

As a result of the above-mentioned factors, we estimate Aerie brand revenues to grow just over 25% annually in the next few years, reaching about $970 million in fiscal 2020.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own