Strong Correlation With Fed’s Benchmark Rates Will Hurt Accenture’s Consulting Revenues For The Year

A comparison of historical changes in consulting revenues for Accenture (NYSE:ACN) with changes in the benchmark interest rate maintained by the Federal Reserve at Trefis, reveals that Accenture’s consulting revenues have been strongly correlated the Fed funds rate over the last five years. We find theses two metrics to be 82% correlated over 2013-2018 – a finding that does not bode well for Accenture’s 2019 revenue figure given the Fed’s softening stance over recent months.

Based on our fundamental analysis, we expect Accenture’s 2019 consulting revenue to be $23.2 billion (+7.5% y-o-y) in 2019 versus $21.6 billion in 2018. This growth implies two rate hikes by the Fed this year from the point of view of our correlation model. However, given that the Fed Chairman has ruled out the possibility of a hike in 2019, Accenture’s consulting revenues for the year may increase just 1.9% to $22 billion. What remains to be seen is if Accenture can beat the historical trend.

An Overview Of Trends in Fed funds rate

The U.S. Fed has been steadily raised rates between 2013 and 2018. However, in March 2019 Fed Chairman Jerome Powell cited weak U.S. growth as potentially halting the increase in rates for 2019. Furthermore, in June 2019 the Fed indicated keeping an open stance to support growth to tide over the economic weakness ensuing from the ongoing trade war with China. Many market participants have construed the Fed’s comments as a signal for a potential rate cut, should the economy need help recovering from the impact of the trade war

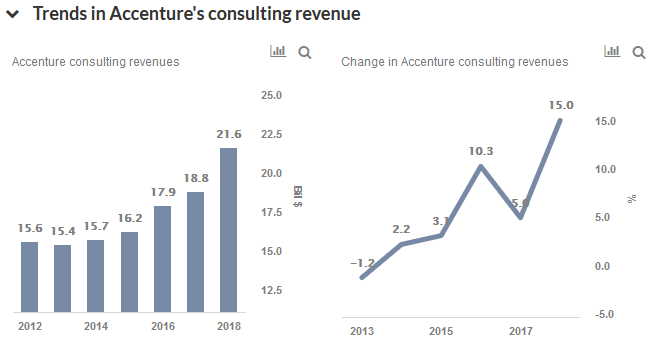

An Overview Of Trends in Accenture’s consulting revenue

- Accenture’s consulting revenues have steadily grown to reach $21.6 billion in 2018 from $15.4 billion in 2013, at a CAGR of 7% over 2013-2018.

- The company’s consulting business focuses on business transformation, to improve effectiveness and reduce cost. Much of the growth in Accenture’s consulting business has been driven by digital transformation and cloud-related work. While some consider these expenses critical to business growth to sustain a competitive advantage, another school of thought considers these expenses discretionary due to the indirect benefits that some of these projects bring to the table.

- Accenture’s management has repeatedly noted that due to the global scope of its clients’ businesses, much of the digital transformation work it undertakes is not considered discretionary by the clients, and hence is likely to face minimal impact in the face of global macroeconomic uncertainty.

- As per our fundamental analysis, we expect Accenture’s consulting revenue to growth to $23.2 billion (+7.5% y-o-y) in 2019 versus $21.6 billion in 2018.

Why Are The Two Metrics Correlated?

Interestingly, over 2013-2018, Accenture’s consulting revenue and the change in Fed Funds rate has moved in tandem with a positive correlation of 82%. The underlying cause is that overall economic growth is helping Accenture’s consulting business. The U.S. Fed increasing rates over this period was essentially a vote of confidence towards a growing economy, and can be seen as a proxy for expected economic growth in the near term. Thus, in light of the recent commentary regarding slower growth, it may not be surprising if Fed were to consider cutting rates.

If we look at Accenture’s consulting revenues purely in correlation with the Fed funds rate:

- In the current environment, with the Fed unlikely to raise rates in 2019, regression suggests that Accenture’s revenue growth for 2019 could fall to 2% and 2019 revenues would be $22 billion. This represents a figure about $1.2 billion lower than our fundamental forecast of $23.2 billion.

- We will be keenly listening to Accenture’s commentary on its next earnings call on Jun 27 to better understand if the company’s bookings can help it tide through this period of uncertainty.

We currently have a price estimate of $170 per share for Accenture, which is roughly 10% below the current market price. Our interactive dashboard on Accenture’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes, and see all Trefis technology company data here.

Do not agree with our forecast? Create your own price forecast for Accenture by changing the base inputs (blue dots) on our interactive dashboard.