Accenture: Will Q2 Momentum Continue In The Second Half?

Accenture (NYSE:ACN) reported its Q2 results on Thursday, March 28. The company beat consensus expectations across revenue and EPS. Furthermore, the momentum in the business appears to have given management the confidence to revise its annual revenue guidance upwards.

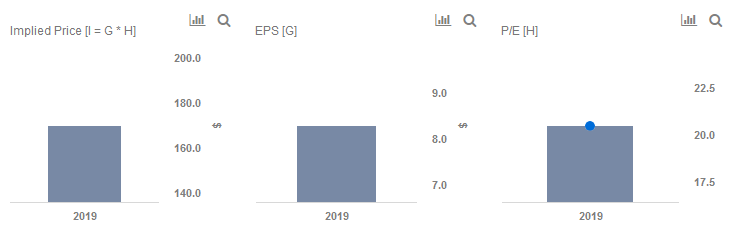

We currently have a price estimate of $170 per share for Accenture, which is about in line with the current market price. Our interactive dashboard on Accenture’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes, and see all Trefis technology company data here.

Some Q2 highlights are detailed below:

- Communications, Media & Technology revenues grew to $2.15 billion (+8% y-o-y).

- Financial Services revenues declined to $2.05 billion (-2% y-o-y). The company’s management maintains that financial services is likely to see further investment in the second half of the year.

- Health & Public Service revenues grew to $1.71 billion (+1% y-o-y). Management noted that the government shutdown led to a 2% impact for the segment. Going forward, a pickup in Accenture’s federal business in the second half of the year should make the impact of the shutdown immaterial.

- Products revenues grew to $2.91 billion (+10% y-o-y).

- Resources revenues grew to $1.64 billion (+17% y-o-y).

- In terms of the actual segments, Consulting revenues grew to $5.79 billion (+6% y-o-y). Segment new bookings were $6.7 billion. Outsourcing revenues grew to $4.67 billion (+5% y-o-y), and segment new bookings were $5.1 billion.

- Total revenue grew to $10.45 billion (+5% y-o-y), which was ahead of the $10.1-10.4 billion range guided by the company for Q2.

- In addition to raising the annual revenue growth guidance to 6.5% to 8.5% (from the earlier 6% to 8%), management also upped its annual EPS expectation to $7.18 to $7.32 (from the earlier $7.01 to $7.25).

- The erstwhile CFO, David Rowland, has taken over the role of Interim Chief Executive Officer. KC McClure, previously head of finance operations, has been promoted to the post of CFO.

A notable observation in management’s commentary was the company’s focus on custom applications. This is a marked change from the processes-oriented approach that has been traditionally undertaken by the service industry to enhance its operating leverage. Accenture appears to have reached a stage wherein its core offerings can now be sliced and diced and tailored to specific customer needs.

Do not agree with our forecast? Create your own price forecast for Accenture by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.