What To Expect From Accenture’s Q2?

Accenture (NYSE:ACN) is scheduled to report its Q2 results on Thursday, March 28. While we expect the company’s overall performance to remain stable, management’s commentary on the recovery in the U.S. Federal business and traction in the broader financial services area is likely to be of key interest.

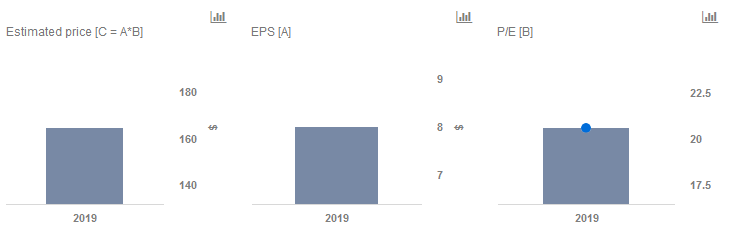

We currently have a price estimate of $165 per share for Accenture, which is around the current market price. Our interactive dashboard on Accenture’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

During its Q1 results, Accenture noted that the company expected to see momentum in the financial services space in Q2. With the Brexit decision (or a further delay) expected to be announced shortly after the company’s results, management’s outlook on the broader financial services market will be closely watched.

Despite the company reaffirming its guidance after the late Chairman and CEO Pierre Nanterme stepped down for health reasons, the markets will also be looking for additional commentary to understand the company’s broader succession planning and ensuing changes.

For fiscal Q2, the company’s management had guided for a revenue range of $10.1-$10.4 billion (+6-9% y-o-y), with a negative FX impact of 4%. The full-year FX impact had been forecast at -3%, with revenue growth guided to come in between 6% and 8%. Full year EPS was expected to grow 4% to 8% to $7.01-7.25.

Going into Q2, we will be watching for any further color on client wins owing to Accenture’s recent acquisitions and the demand environment in light of evolving macroeconomic conditions.

Do not agree with our forecast? Create your own price forecast for Accenture by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.