American Airlines Stock To Tread Water?

As the world economy recovers from pandemic blues, rising transportation demand is putting pressure on crude oil inventories. Thus, high benchmark prices are expected to weigh on the airline industry’s bottom line for a couple of quarters. In the previous quarter, American Airlines (NASDAQ: AAL) highlighted a strategic plan to reduce $15 billion of long-term debt by the end of 2025. The company plans to achieve this target by utilizing cash from operations. Considering AAL’s pre-Covid operating cash flow figure of $3.8 billion, it requires sizable margin improvement to achieve the deleveraging target in the current high fuel cost and uncertain demand environment. We highlight analyst expectations for Q3 2021 along with quarterly trends in revenues, earnings, and stock price in an interactive dashboard analysis, American Airlines Earnings Preview.

[Updated 10/12/2021] – Is American Airlines Stock A Buy After Recent Dip?

- Should You Pick American Airlines Stock At $17?

- What’s Happening With American Airlines Stock?

- Here’s What To Expect From American Airlines’ Q2

- American Airlines Stock Has Seen A 15% Fall This Year Despite Increased Profitability

- Should You Pick American Airlines Stock At $14 After A 6% Fall In A Week?

- With 20% Gains This Month Is Alaska Air A Better Pick Than American Airlines Stock?

As new infections decline, travel and entertainment stocks observe an uptick on anticipation of quick demand recovery in the coming months. However, airline stocks have been on a decline in the past week including American Airlines (NASDAQ: AAL) over concerns of rising operational costs majorly due to high benchmark prices. Despite strong domestic travel demand, AAL stock is likely to trade sideways in the coming month as indicated in our interactive dashboard, American Airlines Stock Price Forecast. The company plans to repay debt from excess operating cash in the next few years, but cost pressure is a headwind to the strategic plan. Currently, AAL’s net debt of $20 billion is sizably higher than its $13 billion market capitalization, as interest expense weighs on shareholder returns.

MACHINE LEARNING ENGINE – try it yourself:

IF AAL stock moved by -5% over five trading days, THEN over the next twenty-one trading days, AAL stock moves an average of 1.3 percent, with a 52.6% probability of a positive return over this period.

Some Fun Scenarios, FAQs & Making Sense of American Airlines Stock Movements:

Q1: Is the price forecast for American Airlines stock higher after a drop?

Answer:

Answer:

Consider two situations,

Case 1: American Airlines stock drops by -5% or more in a week

Case 2: American Airlines stock rises by 5% or more in a week

Is the price forecast for American Airlines stock higher over the subsequent month after Case 1 or Case 2?

AAL stock fares better after Case 1, with an expected return of 1.2% over the next month (21 trading days) under Case 1 (where the stock has just suffered a 5% loss over the previous week), versus, an expected return of 0.2% for Case 2. This implies a price forecast of $20.32 in Case 1 and a figure of $20.10 in Case 2 using AAL market price of $20.07 on 10/11/2021.

In comparison, the S&P 500 has an expected return of 3.1% over the next 21 trading days under Case 1, and an expected return of just 0.5% for Case 2 as detailed in our dashboard that details the expected return for the S&P 500 after a rise or drop.

Try the Trefis machine learning engine above to see for yourself how the forecast for American Airlines stock is likely to changes after any specific gain or loss over a period.

Question 2: Does patience pay?

Answer:

If you buy and hold American Airlines stock, the expectation is over time the near-term fluctuations will cancel out, and the long-term positive trend will favor you – at least if the company is otherwise strong.

Overall, according to data and Trefis machine learning engine’s calculations, patience absolutely pays for most stocks!

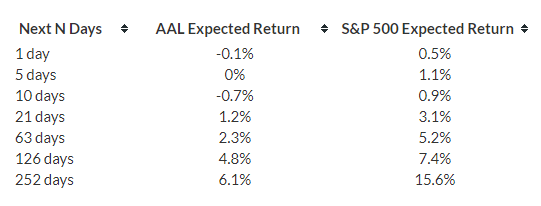

For AAL stock, the returns over the next N days after a -5% change over the last five trading days is detailed in the table below, along with the returns for the S&P500:

You can try the engine to see what this table looks like for American Airlines after a larger loss over the last week, month, or quarter.

Question 3: What about the average return after a rise if you wait for a while?

Answer:

The expected return after a rise is understandably lower than after a drop as detailed in Q1. Interestingly, though, if a stock has gained over the last few days, you would do better to avoid short-term bets for most stocks.

AAL stock returns over the next N days after a 5% change over the last five trading days is detailed in the table below, along with the returns for the S&P500:

It’s pretty powerful to test the trend for yourself for American Airlines stock by changing the inputs in the charts above.

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since 2016.