Has McDonalds Become Too Pricey To Buy or Hold?

Submitted by Julie C at Fast Graphs

We are strong believers in making buy, sell or hold investing decisions predicated on the fundamentals behind the business that the common stock represents. On the other hand, we also acknowledge the undeniable reality that “Mr. Market” does not always price a company according to its intrinsic value based on earnings and cash flows. However, we would further argue that “Mr. Market’s” shenanigans are more apt to apply over the shorter run than they are the over the longer run. To summarize, earnings determine market price in the long run, but investor psychology can play havoc with sound fundamental values over shorter periods of time.

With this article we’re going to take an in-depth look at McDonalds Corp. (MCD) based on its fundamental value by the numbers. There are two primary reasons for writing this particular article at this particular time, both of which were instigated by reader comments and suggestions. First of all, we’ve seen a running debate regarding whether McDonalds (MCD) is fairly valued or overvalued at today’s valuation levels. Second, we’ve been challenged to write articles that were depicting full value or overvaluation because we have typically only written articles on undervalued selections. We believe that because McDonalds had such a strong run in calendar year 2011, that many people believe that it now must be overvalued after rising so much.

- Looking Beyond The Golden Arches: Drop McDonald’s Stock, Pick This Conglomerate?

- Down 14% YTD, What Lies Ahead For McDonald’s Stock Following Q2 Earnings?

- Down 12% This Year, What’s Happening With McDonald’s Stock?

- Dropping 8% Year To Date, Will McDonald’s Stock Recover Post Q1 Results?

- What To Expect From McDonald’s Q4 After Stock Up 13% Since 2023?

- After A 14% Top-Line Growth In Q2 Will McDonald’s Stock Deliver Another Strong Quarter?

McDonalds 2011 performance: Low $72.14 – High $101.00

We believe that most investors are at a disadvantage because they typically are left with making their investment decisions based on price movement alone. As we can see from the price only graph on McDonalds below, stock price rose very strongly throughout calendar year 2011, with only the month of September showing any negative movement (see red circle). Therefore, after an approximately 30% increase in value, many investors automatically assume that the company has become overvalued. On the other hand, as we will soon demonstrate, there is a difference between fairly valued, fully valued and overvalued.

Moreover, there can also be a significant difference between modestly overvalued versus dangerously overvalued. We believe these valuation distinctions are critical ones for investors to make. Understanding these differences will have a significant impact on the risk return relationship. As we will demonstrate, it is possible to buy a stock when it’s fully valued or even modestly overvalued and still be able to generate strong overall performance on your investment. This point will be functionally related to the growth and more precisely, the rate of growth that the business behind the stock is capable of generating.

In other words, a company with powerful and/or explosive growth can overcome the investor mistake of paying a little more than fundamentals would suggest. We will attempt to show that when the investor does this, pay a little more than they should, they take on more risk for the eventual return they achieve. However, if they do this with the right business, the rewards can still be handsome enough to compensate them for the extra risk. Conversely, we will also attempt to clearly illustrate that a smarter purchase is made when valuation is fair, or even better, low. Furthermore, investing at or below fair value enhances future returns while simultaneously lowering risk.

McDonalds: Fundamentally Speaking by the Numbers

Since McDonalds is one of the most widely-recognized brands on the entire planet, it hardly needs any introduction. Therefore, we will refrain from any descriptive dissertation on the company or its business. It’s most likely that most readers will have had a direct experience with McDonalds at one point or the other from visiting one of their restaurants. Instead, our objective will be to examine the fundamental relationship and correlation between McDonalds the business, and McDonalds the common stock.

In order to accomplish this, we are going to run McDonalds (MCD) through its paces utilizing the dynamic fundamentals analyzer software tool F.A.S.T. Graphs™. We’re going to examine McDonalds Corp. over various time frames from long to short in order to measure several important relationships and metrics. First, we are going to evaluate McDonalds’ historical operating earnings history and determine whether the company’s earnings growth is accelerating or decelerating. In other words, has McDonalds’ recent earnings growth been better or worse than its past earnings growth?

Furthermore, we want to discover how “Mr. Market” has traditionally treated McDonalds’ business results by how it has traditionally priced their common stock. And very importantly, we want to evaluate how McDonalds’ current stock price measures up relative to the historical norm. But most importantly of all, we’re going to examine what the future holds for McDonalds’ shareholders given today’s current price and valuation.

McDonalds Corp.: A 20-year History of its Earnings Price Relationship

With our first graph we examine McDonalds’ earnings and price relationship since the beginning of calendar year 1993. The orange line plots McDonalds’ earnings-per-share each year and applies a fair value PE of 15 to its above-average earnings growth rate of 11.5%. Then we correlate monthly closing stock prices (the black line) to the orange earnings justified valuation line which draws a picture of how the market has historically valued McDonalds’ shares relative to their earnings. The dark blue line represents a calculated normal PE ratio which indicates that the market has traditionally priced McDonalds’ shares at a premium to their intrinsic value.

We have marked this graph with several arrows indicating variations in valuation. For the time frame 1998 to 1999 we marked the graph with an arrow marked OV for overvaluation. This is followed by an arrow marked UV for undervaluation for January 2003. Then we offer two arrows marked FV for fully valued at October 2003 and the other at May 2007. Then our final arrow marked IV for intrinsic value points to February 27, 2009 when McDonalds’ stock price was touching the orange line representing True Worth™ valuation.

What we are demonstrating with this exercise is how you can visually see that overvaluation resulted in poor short to intermediate term performance for long-term McDonalds’ shareholders. However, even when McDonalds’ shares were significantly overvalued (1999), true long-term shareholders were still rewarded with capital appreciation if they still own the stock today. However, they would have had to endure several years of losses before the stock price began to rise again. On the other hand, they would have received an increase in dividend income every year even during the times when stock prices were falling.

The graphic also illustrates that those investors with the presence of mind and courage to buy McDonalds’ stock once the price had fallen below the orange earnings justified valuation line were rewarded with excellent long-term returns, and thanks to low valuation, achieved them at below-average risk. Moreover, we can also see that investors that paid full value (the arrows marked FV) also achieved good returns over the long run. And finally, if McDonalds’ shares were bought at intrinsic value, long-term shareholder returns were strong.

The long-term (19-plus year) historical earnings and price correlated graph on McDonalds (MCD) teaches us an important and final lesson on valuation. Notice on the above graph that McDonalds’ stock price was touching the blue normal PE ratio line on the first day of the graph, and likewise is touching it at the closing price on January 30, 2012. Consequently, earnings growth of 11.5% translates into an almost identical capital appreciation (Closing Annualized ROR) of 11.6%.

Furthermore, in addition to the approximately $712,705 of capital appreciation ($100,000 initially invested grew to $809,751.45), McDonalds’ shareholders received total cash dividends in excess of $117,000 that ballooned their total return to over 12.4% per annum. These numbers significantly exceed the numbers produced passively from the S&P 500 index.

Examining the Consistency of McDonalds’ Earnings Growth Record

Next we are going to look at several earnings and dividends only graphs starting with 20 years of history and then followed by subsequently shorter time frames. The purpose of this exercise is twofold. First of all, we want to illustrate how consistently McDonalds has performed as an operating business over time. And second, to show how McDonalds’ earnings growth rate has remarkably accelerated in more recent times, which include the great recession of 2008. With our first chart we once again see that McDonalds grew earnings at 11.5% since 1993.

With the next chart we cut five years off the time frame and measure McDonalds’ earnings growth from 1998 to present. Here we discover a slight deceleration in McDonalds’ earnings growth rate from 11.5% to 11.1%. However, this time period 2001-2003 includes a recession, and represents the three worst performing years in McDonalds’ history since calendar year 1993. Nevertheless, 11.1% earnings growth remained very consistent, all things considered, with their long term historical average.

Things really get interesting when we look at McDonalds’ earnings achievement over the 10 years (9 plus) since 2003, their last poor earnings year. Here we discover that McDonalds’ earnings growth rate has accelerated to an average of 15.8% since calendar year 2003. Later, we will show the impact this had on shareholder performance, especially when considering that this was also a time when McDonalds’ shares were undervalued.

With our next earnings and dividends only graph we look at the last five years (note the graph says six years because we include 2012, which of course has only gone on for one month). Here we discover that McDonalds has continued to generate an above-average earnings growth rate right through and including the great recession of calendar years 2008-2009. Based on this graph, we’re comfortable stating that McDonalds appears to be a very recession-resistant business (see yellow shaded area on bottom the graph).

Re-examining McDonalds’ 10-year Earnings and Price Relationship

With our next graph we reintroduce monthly closing stock prices to our 10-year earnings and dividend only graph on McDonalds. Here we discover that McDonalds’ share price was undervalued at the beginning of calendar year 2003 and currently trades at the highest valuations it has over this 10-year period (9-years plus one month). However, we also see a very highly-correlated long-term relationship where price follows earnings. Notice how every time the price deviates from the orange earnings justified valuation line over or under, it inevitably and usually in short order, returns to fair value.

Furthermore, thanks to this blue-chip company’s consistent and above-average earnings growth rate, there really is no bad time to invest in McDonalds’ stock on this graph. Even if you bought McDonalds’ stock when the price was above the dark blue normal PE ratio line, the investor would have still made money over the longer term. Of course, it’s also clearly evident that the best time to invest in McDonalds is when price sits below the orange line. Clearly, when valuations are lower, so is risk, and better yet, the longer term rate of return is greater also.

A final take-away from this graph is that on a historical basis since calendar year 2003, McDonalds’ stock is clearly trading at a higher than normal valuation. On the other hand, the current valuation is not so high that it would destroy any potential for future returns. Instead, today’s moderate overvaluation would in theory only reduce returns to a less than optimal level. Furthermore, based on historical price action, it would also seem logical to assume that the patient investor would have the opportunity, in the not too distant future, to buy McDonalds when valuations would be better aligned with earnings. At least, this has always happened before, as the graph so vividly depicts.

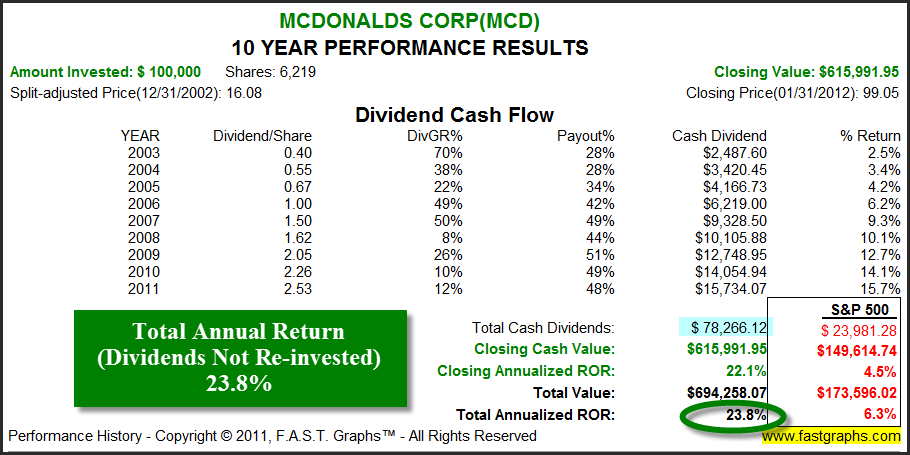

The performance results associated with the above graph illustrates how powerful and rewarding it can be to invest in a great stock where its price is undervalued. McDonalds grew earnings at the above-average rate of 15.8% since calendar year 2003. However, beginning undervaluation accelerated shareholder returns to over 22% per annum based on capital appreciation, and to just under 24% per annum when cumulative dividends are added in (however not reinvested).

Our final historical graph simply shows that although McDonalds’ current blended PE ratio of 18.7 is slightly higher than normal, it is not excessively high. We can see from the below graph that from 1997 through 2002, McDonalds’ PE ratio was much higher at a range between PEs of 24 to 26 times earnings.

McDonalds Looking to the Future

After examining McDonalds’ history over several different time frames we learn that this company has a very consistent record of growing earnings at double-digit rates. Moreover, we also learned that “Mr. Market” has shown a penchant of pricing McDonalds’ shares within reasonable variations of its earnings achievements. However, it’s now time to look to the future in order to answer the question posed by the title of this article of whether or not McDonalds is too rich to buy or hold at today’s prices.

So utilizing our Estimated Earnings and Return Calculator, let’s start out by looking at our default estimates based on the current consensus of 19 analysts reporting to Capital IQ. Here we discover two things that we believe are important. First of all, the consensus of leading analysts expect McDonalds’ earnings to only grow at a below historical average rate of 10% per annum over the next five years.

Moreover, the consensus for calendar year 2012 is for earnings to only grow at 9% (see blue circle) before moving on to the average 5-year growth estimate of 10%. Based on McDonalds’ past history we feel it’s logical to assume that there might at least be a moderately negative bias to current estimates. This seems even stranger when you consider that on January 24, 2012, McDonalds reported fourth quarter calendar year 2011 earnings growth of approximately 15%, and the same number for all of calendar year 2011 (note that our graphs are only showing 2011 earnings growth of 14% and marked with an E for estimate, the official data has not yet filtered through the database).

Assuming that consensus estimates are correct, it would appear that McDonalds’ shares are currently moderately overvalued (share price more than two years ahead of earnings – red line). The four lighter colored orange lines, two above and two below the darker orange line, represent what we like to call the value corridor. Notice that the lines are all parallel to each other and sloped at the estimated growth rate of 10%. Also, the appropriate PE ratios that apply to each of the lines are listed on the scale to the right of the graph. Therefore, the calculated five-year estimated total return of 8.4% per annum, assumes that McDonalds does in fact grow earnings at the consensus rate of 10%, and that the market appropriately capitalizes that growth at a PE of 15.

However, when you consider that McDonalds has grown earnings at 15.7% since calendar year 2007, and that their earnings growth in 2011 was also 15%, the consensus estimate of only 10% seems low. Therefore, utilizing the override feature of the Estimated Earnings and Return Calculator, we will recalculate our expectations for McDonalds’ five-year estimated future growth using their 15.7% historical average. In other words, we are asking “what if” McDonalds continues to grow earnings as it has in the past.

When we redraw the chart using these numbers, we discover that McDonalds may still currently be fully valued where its price is now sitting near the top of the value corridor (the top light orange line). However, we believe it would be a stretch to call it overvalued at today’s price levels. Considering, that if McDonalds was to continue achieving its historical growth, then the potential for a total annual return of approximately 15% or better becomes very real.

The following Earnings Yield Estimator table expresses the Estimated Earnings and Return Calculator in numerical form. This table calculates McDonalds’ annual earnings and annual dividends based on estimating their future earnings growth rate at the same rate of their historical achievement. For a clear perspective of valuation, these estimated earnings and dividend values are compared to what can be earned on a theoretically riskless 10-year Treasury. In other words, if the stock is trading at any type of fair value, then it should obviously be able to generate total cumulative earnings and dividends that are far in excess of what a theoretically riskless investment in a Treasury bond would generate.

Conclusions

Unfortunately, most investors are forced to rely on charts based solely on stock price in order to determine whether the stock is a good buy, sell or hold. Consequently, it’s very easy to become misled by either a rapidly rising or rapidly falling stock price. We believe that the only way to really have a clear vision of the appropriateness of investing in any given stock is when price and fundamentals can be viewed simultaneously.

When you examine the 20-year earnings (fundamentals) and price correlated graph on McDonalds, the relationship between fundamentals and stock price can be vividly seen. Therefore, more appropriate buy, sell or hold decisions can be made based on a sound foundation of fundamentals. This is not to imply that perfect decisions can be made, but we believe it is clear that when price and fundamentals are viewed in concert with each other, a more learned perspective is attained.

When applying these principles to McDonalds’ current valuation, it appears that McDonalds’ stock is currently fully priced, but once again, we would stop short of calling it overpriced. Although we would not purchase McDonalds’ stock at today’s prices, we only make that decision based on the belief that sometime in the near future we might be given the opportunity to invest in this blue-chip at a better valuation. This opinion is founded upon the principles of valuing earnings, and the long-term history of how the market has specifically valued McDonalds’ earnings. Consequently, we currently rate McDonalds a long-term hold.

Disclosure: Long MCD at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.