Intel’s Aggressive Push In IoT Positions It Well To Leverage Growth In The Market

The annual Intel Developer Forum (IDF) held in San Fransisco last week underlined Intel’s (NASDAQ:INTC) increasing focus on Internet-of-Things (IoT) and wearable technology. For years, the leading PC microprocessor company has used IDF as a platform to update investors primarily about its PC processors roadmap, but this time the key focus and the flavor of the year was IoT. Intel introduced a number of new products, tools and programs that support the growing personalization of computing across a wide range of technologies. (Read Intel’s Press Release for a complete list)

For over two decades, Intel has been the undisputed leader in the PC chip market, accounting for a subtantial majority of global microprocessor sales. However, the chipmaker’s topline growth has been hit by a slowdown in PC sales over the last few years. The fact that Intel was a late entrant in the mobile chip market, and as a result is still struggling to catch up with Qualcomm (which is a leader in mobile chips), added to its woes. Learning from its short-shortsightedness in the smartphone market, Intel is determined to be one of the early entrants in IoT and has been aggressively investing to gain a wide footprint in the space.

Can IoT be the next big thing for Intel, drastically lowering the company’s dependence on the PC market? We explore this question in the article below.

Our current price estimate of $35 for Intel is at a significant premium to the current market price.

See our complete analysis for Intel

IoT Will Fuel The Next Growth Phase of The Semiconductor Industry

IoT includes all other computing devices apart from PCs, tablets and smartphones; or as McKinsey puts it, it is the networking of physical objects through the use of embedded sensors, actuators, and other devices that can collect or transmit information about the objects. [1] IoT is still at a nascent stage, but it is expanding fast and is considered to be the next big growth driver in the semiconductor industry, after smartphones and tablets. In fact, various companies from diverse industries such as healthcare, industrial, automotive, consumer, consulting etc., are all vying to grab a share of this fast-growing market opportunity.

According to Cisco Consulting Services, IoT has the potential to unleash $19 trillion of global economic value, by 2024, through new innovations, revenues streams, better customer experiences, enhanced asset utilization, improved employee productivity, and efficient supply chain and logistics operations. McKinsey Global Institute estimates that the impact of IoT on the global economy can be as high as $6.2 trillion by 2025. The installed base for IoT devices is estimated to grow from around 10 billion connected devices today to as many as 30 billion devices by 2020.

The exponential increase in IoT devices will increase demand for microcontrollers, miroprocessors, connectivity chips, memory chips etc., which will help drive the next wave of growth for semiconductor companies. Additionally, the data generated from billions of these connected devices will need to be processed and require greater storage capacity, fuelling demand for data centers.

Intel Is At The Forefront Of IoT

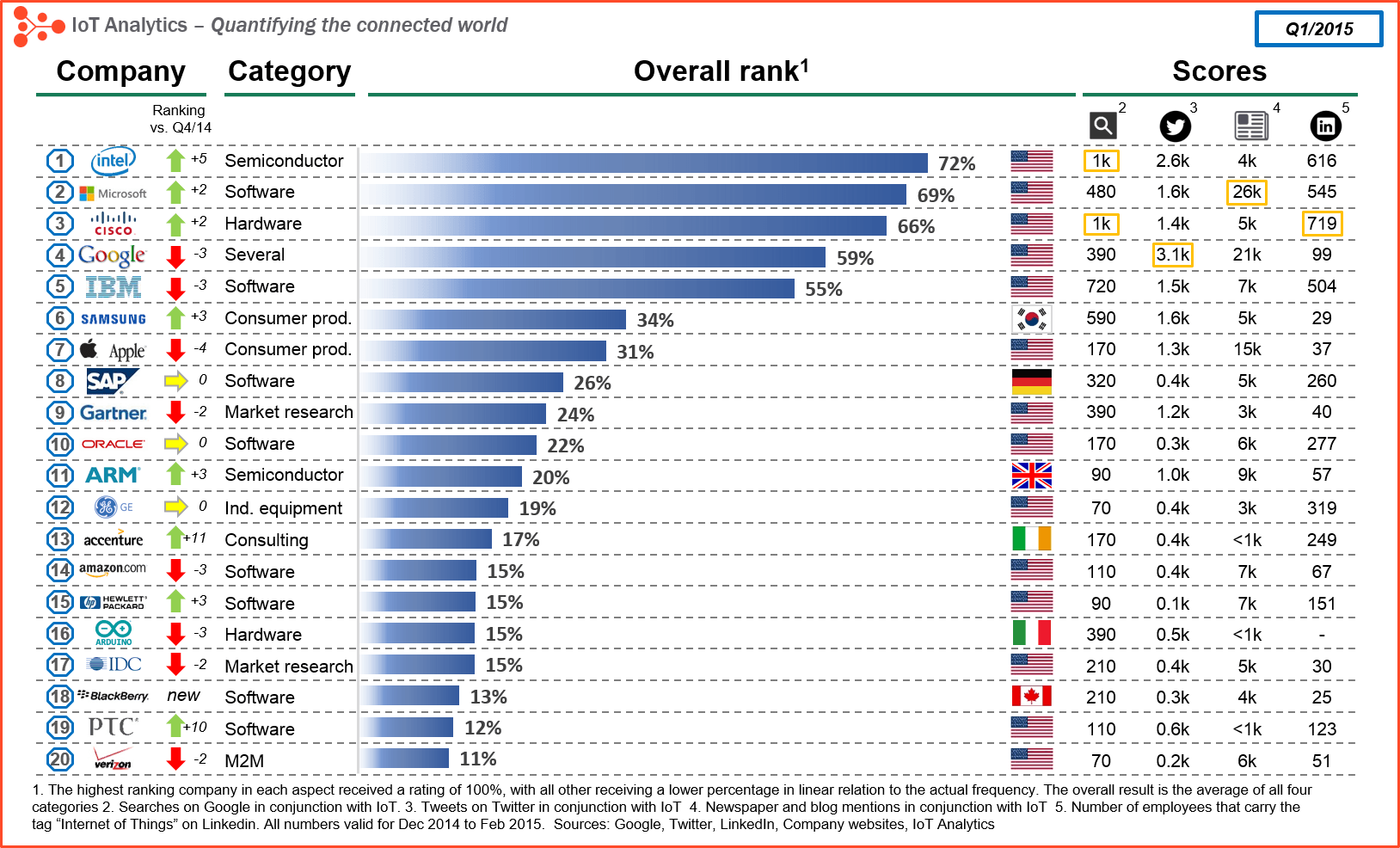

The research firm IoT Analytics has recently placed Intel at the head of the top 20 IoT companies (as we see in their graphic below). [2] Indeed, Intel is at the forefront of developing new generation low-power chips for connected IoT devices. In addition to introducing new platforms, the company has launched a number of products and initiatives in the past year with different fashion, fitness and lifestyle brands, to accelerate its presence in wearables. These include the acquisition of Basis Science, the partnership with renowned rapper 50 Cent to create fitness-tracking headphones, the collaboration with Opening Ceremony to launch a fashion accessory MICA, as well as the partnership with Fossil, Tag Heuer and Luxottica, among many others. Intel also has a reference platform which makes it easier for customers to implement their own IoT solutions and deliver innovations to market faster. Accenture, Booz Allen Hamilton, Capgemini, Dell, HCL, NTT DATA, SAP, Tata Consultancy Services Ltd., Wipro and others are joining together with Intel to develop and deploy solutions using their building blocks on the Intel IoT Platform.

Source: IoT Analytics

Last year, Intel changed its reporting structure and made IoT a stand-alone segment, underlining its growing focus on the business. Though the company continues to depend on the PC market for a significant portion of its revenue, PCs now account for approximately 60% of Intel’s total revenue as apposed to well over 90% a few years back.

Intel currently derives less than 10% of its valuation and approximately 5% of its revenue from the IoT segment. We believe that accelerating its entry in IoT augurs well for Intel’s long term growth potential, and estimate the segment will account for approximately 10% of Intel’s total revenue by the end of our forecast period. On the contrary, we forecast the revenue contribution from PCs to continue declining over our review period.

Given the growth opportunities in IoT, there is a possibility that we are underestimating Intel’s growth potential in this market. In this event, the revenue contribution from this segment could increase to a much higher level than we currently forecast. For example, despite the vast growth potential in the automotive segment, Intel still has a long way to go to make a mark in this sub-segment of IoT. Given Intel’s technology prowess, it won’t be a big surprise if Intel steps up its effort in the auto segment and becomes one of the key suppliers of In-Car Infotainment and Advanced Driver Assistance System silicon.

Spending $11 billion in research last year, Intel probably has the biggest R&D kitty in the semiconductor industry. Its technology prowess combined with its in-house manufacturing facility gives it an edge over other players in the market. Unlike the mobile market, we believe Intel entered the IoT space at just the right time (considering its still at a nascent stage) and is in a strong position to emerge as one of key beneficiaries of the strong growth potential in the market.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap More Trefis Research

Notes:- The Internet of Things: Sizing up the opportunity, McKinsey, December 2014 [↩]

- Read their “The Top 20 Internet of Things Companies Right Now: Intel Overtakes Google“ [↩]