A Comparative Look At The Valuation Of Amazon, Alibaba and eBay

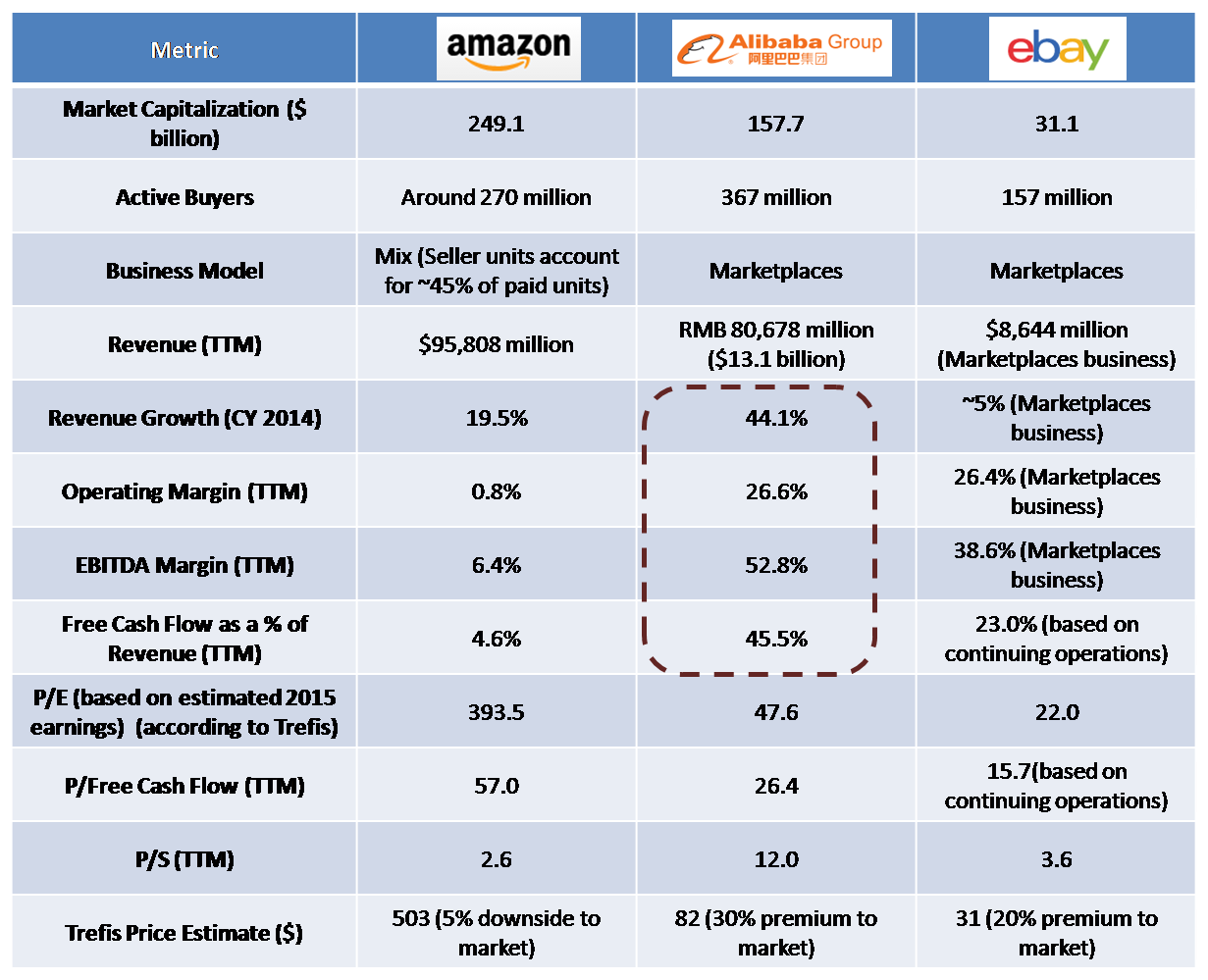

Amazon (NASDAQ:AMZN), eBay (NASDAQ:EBAY) and Alibaba (NYSE:BABA) represent the leading companies in the global e-commerce sector. In this article, we take a look at the fundamentals and market valuations of these online retail giants to see which stock looks cheaper. In our view, Amazon’s stock appears to be trading around fair price, with respect to its current valuation metrics and its forecasted revenue growth. In contrast, we believe Alibaba’s stock represents a buying opportunity vis-a-vis its growth fundamentals and strong margins. Under a more base-case scenario for the Chinese economy, we believe Alibaba could continue to see healthy growth in the coming years, owing to the rapid growth being seen in the country’s e-retail market. Simultaneously, we think eBay’s stock could see some upside in the coming future, owing to its cash-rich business model and some recovery in its marketplaces business.

See our complete analysis for eBay

Amazon’s stock has run up by over 45% over the past six months, driven by various positives such as an improvement in profitability and higher than expected top-line and bottom-line results in the cloud services business. The company supports the highest valuation among its peers in the online retail sector. Amazon’s revenue is not directly comparable to that of Alibaba and eBay; the latter two companies operate as marketplaces, in which they do not own any inventory and only act as a medium between third-party sellers and buyers. In contrast, Amazon owns a large portion of the inventory it sells on its websites; however, it is also moving towards the marketplaces business model. Third-party owned units accounted for around 45% of all paid units sold during the most recent quarterly results. This varied business model also displays lower profitability, given the degree to which Amazon competes on price. In addition, we think the company is undertaking various investments in several growth strategies (such as Prime, content, cloud services, etc), and hence its margins cannot be directly compared to those of eBay and Alibaba.

We believe Amazon’s market price is almost fairly-valued presently, since the company’s top-line outlook over the next 5-10 years looks quite strong, in our view. We estimate the company will gain market share over the coming years, in both the U.S. as well as in the international online retail market. At the same time, an improvement in profitability will lead to generation of significant cash flows over the long-run.

Alibaba:

After generating a lot of heat post its IPO last year, when Alibaba’s stock almost climbed up to $120, the Chinese e-commerce behemoth more recently seems to be losing favor with Wall Street investors. A host of concerns, spanning from counterfeit products on its platform to risks in the Chinese economy and increased competition from JD.com, have weighed on the company’s stock over the past few months. However, we think Alibaba’s stock could represent a unique buying opportunity at this point. This is as the company’s financials—primarily revenue growth, EBITDA and free cash flow margins—look promising (as can be seen in the table above). Our $82 price estimate for Alibaba’s stock represents near 30% premium to the current stock price, as we believe the company will continue to account for a dominant share of the Chinese e-commerce market. Plus, the rapid growth in the Chinese e-commerce market is expected to continue in the near-term, owing to rising Internet penetration in the country. Moreover, we have a positive view of Alibaba’s investments in the online-to-offline (O2O), mobile, and cloud computing services businesses. We believe these bets could pay-off over the next five years, leading to corresponding rise in Alibaba’s profitability.

eBay:

After the recent divestiture of its payments business, eBay has a number of challenges ahead to regain its prominence in the e-commerce market. Battling increased competition and a drop in traffic due (the result of the Google Panda update and last year’s security breach), eBay’s management will find it hard to accelerate the company’s business in the coming years. As a result, we forecast eBay will lose some market share in the global e-commerce market over our forecast horizon. On the positive end, the company’s marketplaces business model leads to the generation of healthy cash flows. Plus, the company’s margins are quite stable and high (as compared with Amazon). At current valuation ratios, we believe eBay’s stock is trading cheaply with respect to its fair price, even after factoring in the drop in market share. Our $31 price estimate for the company’s stock represents more than 20% upside to the current market price.

View Interactive Institutional Research (Powered by Trefis):