Dissecting Dow And DuPont Deal, Part 1: Does The Merger Make Sense?

DOW Chemicals (NYSE: DOW) and Du Pont (NYSE: DD) recently announced merger which will value the combined entity at about $130 billion. The shareholders of the two companies extended approval for the merger last month, and the deal is expected to be completed in the second half of 2016 subject to regulatory approvals. We believe the merger makes sense as it will allow the two companies to navigate recent challenges in the agricultural and chemical industries, and unlock shareholder value by eliminating redundant operations. The two companies have been facing pressure from activist investors because of stagnation resulting from the global slowdown, declining commodity prices, the strengthening dollar and bloated cost structures.

Consolidation makes sense in the face of slowdown

Dow and DuPont have seen their revenue decrease across various segments over the last few years. This can be attributed to low crop prices resulting in decreased demand, competitive pressure, strengthening of the U.S. dollar and falling oil prices. While the demand for corn has improved recently, there is weakness in soybean and crop protection demand.

- Will Dow Stock Recover To Its Pre-Inflation Shock Highs?

- After A 2x Rally Dow Inc Stock Appears To Be Vulnerable

- Dow Chemical Benefits From Price Increases

- Revisiting Dow-DuPont Merger Motivation As The Companies Win U.S. Anti-Trust Approval

- How Will Dow’s New Texas Polyethylene Plant Help?

- Dow’s Impressive Earnings, Upcoming Merger Make It Interesting Going Forward

The slowdown in the industry has prompted other players to pursue inorganic growth as well. The revenue growth of Monsanto and Syngenta has been flat for the past few years while over the last three years BASF’s (agriculture division only) revenue declined by about 3%. Monsanto had tried to acquire Syngenta in the past but withdrew later. Presently, ChemChina is in discussion to acquire Syngenta and Bayer has proposed the acquisition of largest agro-chemical player Monsanto for about $62 billion.

The merger will help create industry leading position for Dow and DuPont

The merger will give the combined entity a comprehensive array of products in agriculture, material science & speciality products segments. The new company will become a dominant player in agricultural and material sciences industry.

This will help the companies gain significant bargaining power over their suppliers and to some extent, customers. Bargaining power becomes important in an industry which faces growth challenges and margin improvement becomes a critical source of value. Additionally, the size advantage should help the combined companies in terms of access to funds for growth and ward off competition.

Overlapping geographies provide opportunity

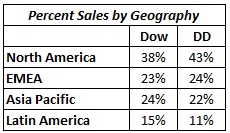

The two companies are present in overlapping geographies which gives an opportunity to eliminate costs and grow revenues.

Dow and DuPont estimate cost synergy of approximately $3 billion driven by reducing COGS (40%), SG&A (30%), leveraged & corporate costs (20%), and R&D expense (10%) and, an additional revenue synergy of $1 billion. Both the companies have been independently cutting costs. Du Pont has plans to cut its expenses by $135 million and $220 million in Q1 and Q2 of FY’16. It plans to trim its workforce by 10% in 2016.